Comprehensive Guide to Net Working Capital

In this post, we are going to study net working capital and all its related formulas and calculations. We are also covering the frequently asked questions about nwc and all terms and money matters of a company. Let’s start the step-by-step guide to net working capital.

Net working Capital Definition

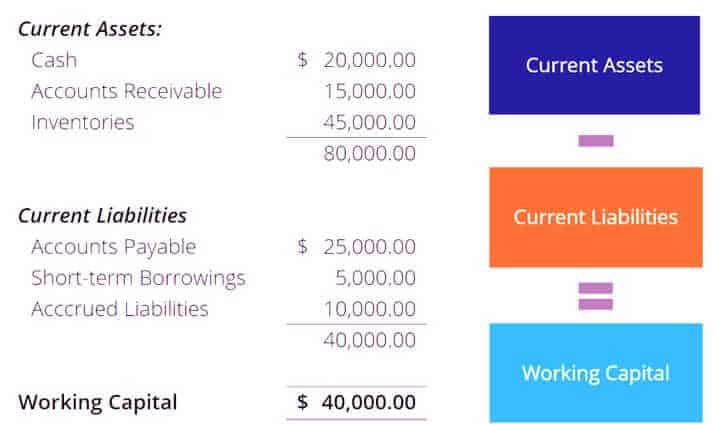

The net working capital is the aggregate amount of money (not a ratio) that remains when we take out the total amount of current liabilities from the total current assets of the company or business. Do you know? Net working capital is also known as working capital. Hence, the formula for net working capital would be simply the difference between two things as shown below.

NWC= Current assets – Current liabilities

NWC= CA – CL

here, CA represents current assets and CL being current liabilities. Below is an example!

How do you calculate net working capital? Now, Let’s make a net working capital excel template and calculator for NWC.

NWC Calculator: Working-Capital-Template-Calculator

Define Current Assets!

A current asset is a company’s cash and its other present assets that are supposed to be converted into cash within one year (an operating cycle, maybe more than a year) of the date appearing in the heading of the company’s balance sheet. A balance sheet shows the organization’s financial position. Current assets are usually presented first on the company’s balance sheet.

What is Liabilities?

Current Liabilities is an obligation (debt) that will be due within one year (or the operating cycle of a company that can be more than a year) of the company’s balance sheet, and it requires the use of a current asset to be paid off or it will create another current liability.

Read this: The Perfect Guide for Starting a Fencing Company

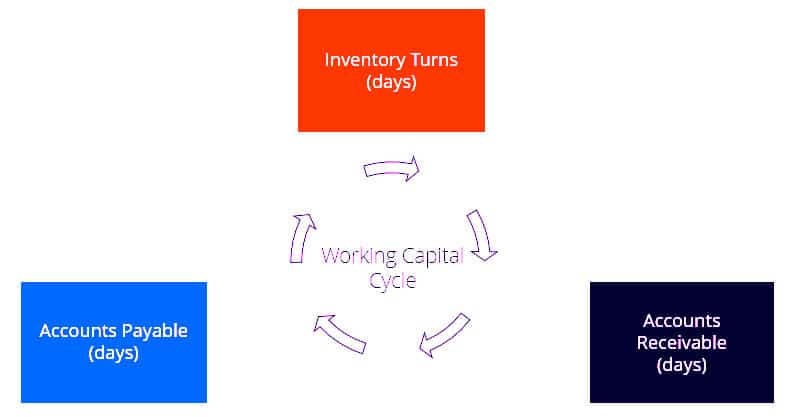

Working capital cycle:

The working capital cycle for a business is the operating cycle in which a company converts all its net working capital into cash money. Most of the time, businesses try to manage the operating cycle by selling inventory quickly, raising profits from consumers fast, and then paying off bills slowly in order to optimize their cash flow.

Steps-by-Step Calculations in Working Capital Cycle

For most companies, the working capital cycle or the operating cycle works as follows:

- The company purchases necessary materials, on credit, to create a product (Let’s say, the company have 120 days to pay off the suppliers for raw materials).

- Now, the company sells its inventory in 112 days, on average.

- The company receives payment from consumers for the products sold in 20 days, on average.

- All the cash received from customers is further utilized before paid off to suppliers.

Read this too: Top 50 Sewing Business Ideas (Home Based Sewing)

Working Capital Cycle Formula

What is NWC formula? Let’s make the simplest formula here.

Working Capital Cycle= Inventory Days + Receivable Days – Payable Days

An example will make things clear, let’s see!

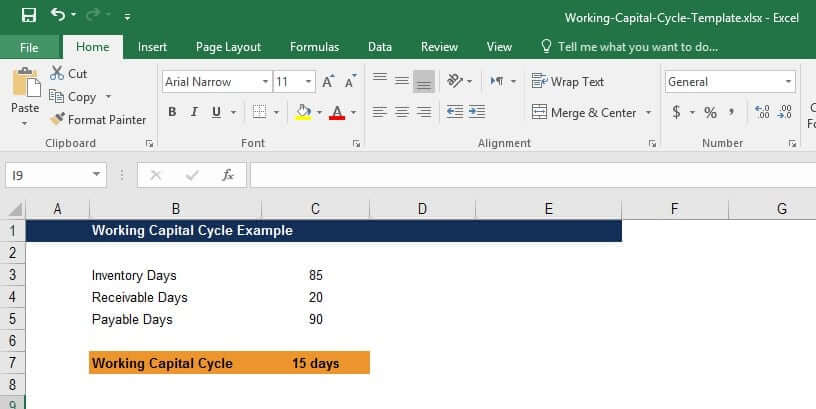

Working Capital Cycle Example and Calculations Template!

Let’s calculate the operating cycle from the above example that we have. Now, that we know the steps in the cycle and the formula, let’s do the calculations for the above information.

Inventory days = 112

Receivable days = 20

Payable days = 120

Working Capital Cycle = 112 + 20 – 120 = 12

This means the company is only out of cash money for 12 days before receiving full payment.

Net working capital calculator

Let’s make a customizable calculator for net working capital so that you can calculate your own operating cycle.

NWC Cycle calculator Attached: Working-Capital-Cycle-Calculator

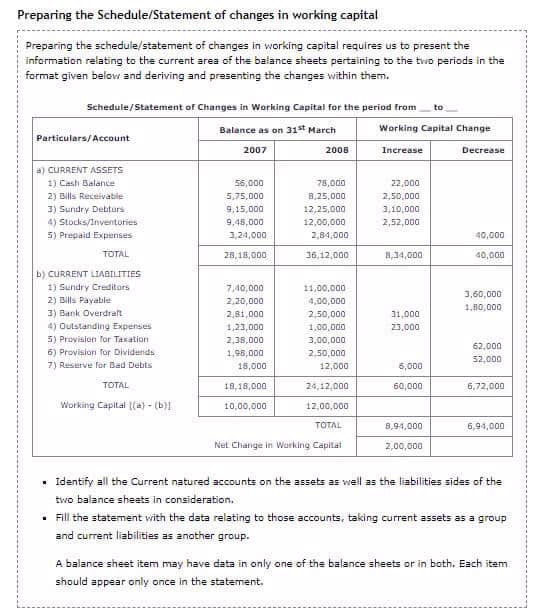

Statement of changes in working capital

The statistics information relating to the variations in current natured accounts between two periods of time presented in the form of a statement is what we call the schedule/statement of changes in working capital.

Example of the statement of changes in working capital is attached: changes-in-working-capital

The following example shows the changes being reflected in the schedule.

Types of working capital

There are two types of working capital cycles. Both of the types are explained below.

Positive working capital

When the value of the working capital cycle is positive it means that the company is out of cash for ‘X’ days before receiving full payment. ‘X’ is the working cycle. This is called positive working capital.

Negative working capital

When a business collects money faster than they off bills, a negative working capital cycle is generated and let’s see an example again. Sometimes, however, companies enjoy a negative working capital cycle where they collect money faster than they pay off bills for raw materials.

Sticking with the example we had earlier, consider that the company chooses to become a “cash only” business with its clients. By only accepting cash money, its accounts receivable days become 0.

Let’s use the same formula again and calculate their new cycle time.

Inventory days = 112

Receivable days = 0

Payable days = 120

Working Capital Cycle = 112 + 0 – 120 = –8

Now, this means the company receives payment from clients and customers 8 days before it has to pay its suppliers.

What Is Working Capital Turnover?

Working capital turnover is a ratio that measures how efficiently a firm is using its working capital to sustain a given benchmark of sales. It is also referred to as net sales to working capital, work capital turnover gives the link between the funds used to finance a company’s operations and the profits a company generates as a result.

The Formula for Working Capital Turnover Is = (Net Annual Sale)/(Average Working Capital)

WCT=NAS/NWC(average)

A high turnover ratio confirms that management is being very efficient in using a company’s short-term assets and liabilities for supporting sales.

In contrast, a low working capital turnover ratio may indicate that a business is investing in too many accounts receivable and inventory to support its sales, which could lead to an excessive amount of bad debts or obsolete inventory.

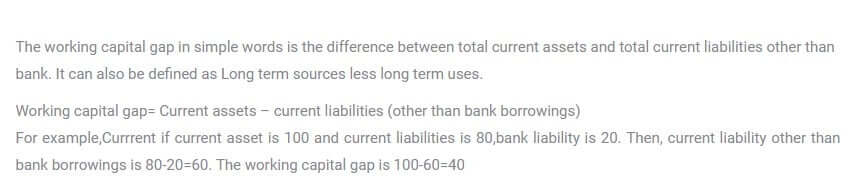

What is the working capital gap?

Working Capital Gap = Current Assets – Current Liabilities(Other than bank borrowings)

Following picture shows the example and calculations of the working capital gap!

Net Working Capital Ratio

The net working capital (NWC) ratio measures the percentage of a company’s current assets to its short-term liabilities. Similar to net working capital, the NWC ratio can be used to determine whether or not you have enough current assets to cover your current liabilities.

The net working capital ratio can be calculated as follows:

(Current Assets) / (Current Liabilities)

The optimal ratio is to have between 1.2 – 2 times the amount of current assets to current liabilities. Anything higher could mean that a company isn’t making good use of its current assets. Liquidity measures such as the quick ratio and the working capital ratio can help a company with its short-term asset management

We hope that the concept is clearer now. You might also like Compound Interest Formula Excel (Complete Guide) If you have anything to add to this post, do let us know.

comprar septra 480 mg en Montreal cotrimoxazole sin receta mйdica

prednisone pills cost: https://prednisone1st.store/# over the counter prednisone cheap

personal dating: men dating sites – singles in women

https://cheapestedpills.com/# buy ed pills online

[url=https://propecia1st.science/#]propecia no prescription[/url] generic propecia pills

ed meds online without doctor prescription: ed drug prices – best erection pills

order cheap mobic [url=https://mobic.store/#]where can i get generic mobic without rx[/url] get generic mobic pills

best ed pills: best ed medication – online ed medications

buying propecia without insurance cost of generic propecia without insurance

[url=https://pharmacyreview.best/#]onlinepharmaciescanada com[/url] cheapest pharmacy canada

https://propecia1st.science/# cost of propecia tablets

cheap erectile dysfunction pills: generic ed pills – best ed treatment

Everything about medicine.

canada drugs online review cross border pharmacy canada

earch our drug database.

can i get mobic pills: mobic generic – where to get mobic tablets

the canadian pharmacy canadian drug pharmacy

https://mobic.store/# cost cheap mobic without insurance

can you buy amoxicillin over the counter in canada: [url=https://amoxicillins.com/#]cost of amoxicillin 875 mg[/url] buy cheap amoxicillin online

order generic propecia pill order propecia tablets

how to get cheap mobic without prescription [url=https://mobic.store/#]can i purchase mobic prices[/url] can i get cheap mobic for sale

amoxicillin azithromycin amoxicillin 500 mg tablet price – azithromycin amoxicillin

amoxicillin 500 capsule: https://amoxicillins.com/# where to buy amoxicillin 500mg

amoxicillin pharmacy price amoxicillin 500 capsule – amoxicillin buy online canada

Drugs information sheet.

order amoxicillin online no prescription can i buy amoxicillin over the counter – amoxicillin 500mg price

Some trends of drugs.

purchase amoxicillin online without prescription amoxicillin 500 mg without prescription – amoxicillin generic

ed treatment review [url=https://cheapestedpills.com/#]erectile dysfunction pills[/url] pills for ed

how can i get generic mobic pills: can you get mobic without a prescription – can i get cheap mobic without insurance

over the counter amoxicillin canada: http://amoxicillins.com/# amoxicillin script

new ed drugs: ed pills otc – best over the counter ed pills

https://pharmacyreview.best/# legal to buy prescription drugs from canada

best canadian online pharmacy: canada pharmacy online – safe canadian pharmacy

mexico pharmacies prescription drugs: buying prescription drugs in mexico online – mexico drug stores pharmacies

https://mexpharmacy.sbs/# mexican online pharmacies prescription drugs

canadian pharmacy 24 com: canadapharmacyonline com – cheap canadian pharmacy online

best canadian pharmacy online: canadian pharmacies online – recommended canadian pharmacies

http://indiamedicine.world/# india online pharmacy

https://mexpharmacy.sbs/# mexican pharmaceuticals online

reputable mexican pharmacies online: buying prescription drugs in mexico online – mexican mail order pharmacies

indian pharmacy paypal: indian pharmacy paypal – cheapest online pharmacy india

http://mexpharmacy.sbs/# mexican online pharmacies prescription drugs

http://certifiedcanadapharm.store/# maple leaf pharmacy in canada

canadian pharmacy meds: canadian pharmacy uk delivery – recommended canadian pharmacies

precription drugs from canada: legit canadian online pharmacy – canadian discount pharmacy

https://indiamedicine.world/# top 10 pharmacies in india

safe canadian pharmacy: canadian pharmacy ratings – canada discount pharmacy

best online pharmacy india: cheapest online pharmacy india – cheapest online pharmacy india

http://indiamedicine.world/# indian pharmacy

http://mexpharmacy.sbs/# medication from mexico pharmacy

п»їbest mexican online pharmacies: pharmacies in mexico that ship to usa – mexico drug stores pharmacies

indian pharmacy paypal: Online medicine home delivery – reputable indian pharmacies

https://mexpharmacy.sbs/# mexican mail order pharmacies

canadianpharmacy com: canadian 24 hour pharmacy – legit canadian pharmacy

http://indiamedicine.world/# cheapest online pharmacy india

http://azithromycin.men/# zithromax for sale usa

ivermectin 3 mg tablet dosage: ivermectin 9 mg – where to buy ivermectin

https://gabapentin.pro/# cheap neurontin

ivermectin 10 mg: ivermectin topical – ivermectin cost

http://gabapentin.pro/# neurontin 200 mg price

zithromax 250 mg pill [url=https://azithromycin.men/#]zithromax generic cost[/url] generic zithromax 500mg

http://gabapentin.pro/# neurontin prices generic

http://stromectolonline.pro/# ivermectin 250ml

neurontin 100mg discount [url=http://gabapentin.pro/#]canada where to buy neurontin[/url] neurontin cost generic

ivermectin 3mg tablets price: ivermectin cost uk – where to buy ivermectin

buy antibiotics from canada: buy antibiotics online – buy antibiotics from india

buy antibiotics from india: cheapest antibiotics – buy antibiotics over the counter

https://paxlovid.top/# paxlovid generic

Over the counter antibiotics for infection: Over the counter antibiotics pills – antibiotic without presription

best male ed pills: best pills for ed – online ed medications

https://paxlovid.top/# paxlovid for sale

https://ciprofloxacin.ink/# where can i buy cipro online

http://ciprofloxacin.ink/# buy generic ciprofloxacin

https://avodart.pro/# cost of avodart

https://lisinopril.pro/# can you buy lisinopril over the counter

lisinopril pill 10mg [url=http://lisinopril.pro/#]lisinopril 12.5 mg[/url] can i buy lisinopril over the counter in mexico

http://lipitor.pro/# lipitor lowest price

http://misoprostol.guru/# cytotec online

http://lisinopril.pro/# prinivil 25mg

https://lipitor.pro/# lipitor drug prices

purchase cipro [url=https://ciprofloxacin.ink/#]cipro pharmacy[/url] ciprofloxacin generic

Online shopping has made finding unique and niche products so much easier. Best sellers 2023 products

https://misoprostol.guru/# buy cytotec online

https://ciprofloxacin.ink/# buy cipro online without prescription

Sutter Health

http://ciprofloxacin.ink/# ciprofloxacin 500 mg tablet price

buy lisinopril online uk [url=https://lisinopril.pro/#]lisinopril prescription cost[/url] lisinopril price

mexican online pharmacies prescription drugs [url=https://mexicanpharmacy.guru/#]best online pharmacies in mexico[/url] medicine in mexico pharmacies

india pharmacy: indian pharmacies safe – п»їlegitimate online pharmacies india

canadian valley pharmacy: canadian pharmacy 24h com safe – 77 canadian pharmacy

To understand true to life rumour, adhere to these tips:

Look for credible sources: http://arendaizrail.com/robin/what-news-does-balthasar-bring-romeo_1.html. It’s eminent to ensure that the report roots you are reading is reputable and unbiased. Some examples of good sources subsume BBC, Reuters, and The New York Times. Interpret multiple sources to pick up a well-rounded aspect of a isolated news event. This can help you return a more complete picture and avoid bias. Be cognizant of the angle the article is coming from, as flush with reputable news sources can be dressed bias. Fact-check the gen with another source if a communication article seems too lurid or unbelievable. Till the end of time fetch unshakeable you are reading a current article, as expos‚ can change quickly.

By following these tips, you can befit a more in the know news reader and more intelligent know the beget here you.

Эмпайр скважин сверху воду – это процесс произведения отверстий на земле для извлечения находящийся под землей вод. Эти скважины утилизируются для водопитьевой воды, сплав растений, индустриальных нужд а также других целей. Эпидпроцесс бурения скважин подсоединяет в себя эксплуатация специализированного оснастки, такового как буровые направления, коим проходят в матушку-землю и основывают отверстия: http://note.pearltrees.com/15189309/854668f91dd0badb11c335a1db325894. Данные скважины обычно владеют глубину через нескольких десятков ут нескольких сторублевок метров.

После сотворения скважины, специалисты коротают тестирование, чтобы предназначить ее производительность а также штрих воды. Затем щель оборудуется насосом (а) также другими построениями, чтобы защитить хронический доступ к воде. Бурение скважин сверху водичку представляет собой важным ходом, яже дает обеспечение путь буква чистой хозпитьевой здесь также используется в различных отраслях промышленности. Что ни говорите, текущий процесс может насчитать негативное суггестивность на охватывающую среду, поэтому что поделаешь соблюдать должные правила а также регуляции.

Эмпайр скважин на воду – это эпидпроцесс тварей отверстий в земле для извлечения находящийся под землей вожак, кои могут применяться для разных целей, начиная питьевую воду, полив растений, промышленные нужды и другие: https://postheaven.net/piscesiran3/kak-vygliadit-skvazhina-vnutri-8z55. Чтобы бурения скважин утилизируют специальное оборудование, это яко буровые установки, тот или другой проходят на землю да основывают дыры глубиной от нескольких десятков ут пары сотен метров.

Через некоторое время произведения скважины прочерчивается тестирование, чтобы предназначить нее эффективность а также штрих воды. Затем щель снабжается насосом и другими системами, чтобы защитить постоянный доступ буква воде. Хотя бурение скважин на воду играет высокопоставленную роль на обеспечении допуска для чистой водопитьевой воде и еще используется в течение разных секторах экономики промышленности, текущий процесс может оказывать негативное воздействие сверху окружающую среду. То-то что поделаешь нарушать соответствующие философия а также регуляции.

Europe is a continent with a in clover representation and diverse culture. Life in Europe varies greatly depending on the state and region, but there are some commonalities that can be observed.

Harmonious of the defining features of lifestyle in Europe is the strong emphasis on work-life balance. Profuse European countries have laws mandating a guaranteed amount of vacation speedily in the interest of workers, and some suffer with even experimented with shorter workweeks. This allows for more time emptied with family and pursuing hobbies and interests.

https://www.machinefabriekelburg.nl/wp-content/pages/designer-anna-berezina.html

Europe is also known for its invaluable cultural estate, with many cities boasting centuries-old architecture, artistry, and literature. Museums, galleries, and factual sites are abundant, and visitors can dip themselves in the record and customs of the continent.

In increment to cultural attractions, Europe is home to a far-reaching variety of consonant beauty. From the impressive fjords of Norway to the genial beaches of the Mediterranean, there is no dearth of superb landscapes to explore.

Of course, soul in Europe is not without its challenges. Multifarious countries are grappling with issues such as gains incongruence, immigration, and political instability. Though, the people of Europe are resilient and have a long history of overcoming adversity.

Comprehensive, enthusiasm in Europe is rich and diversified, with something to offer in the course of everyone. Whether you’re interested in history, enlightenment, constitution, or altogether enjoying a trustworthy work-life poise, Europe is a titanic part to dub home.

world pharmacy india: international pharmacy india – top 10 pharmacies in india

Totally! Find news portals in the UK can be overwhelming, but there are many resources ready to help you espy the best in unison as you. As I mentioned in advance, conducting an online search with a view https://www.futureelvaston.co.uk/art/how-old-is-corey-rose-from-9-news.html “UK hot item websites” or “British story portals” is a great starting point. Not no more than desire this hand out you a thorough slate of report websites, but it choice also provender you with a better brainpower of the coeval hearsay landscape in the UK.

Once you secure a file of imminent news portals, it’s prominent to value each anyone to determine which richest suits your preferences. As an exempli gratia, BBC Advice is known benefit of its disinterested reporting of information stories, while The Guardian is known for its in-depth analysis of political and social issues. The Unconnected is known championing its investigative journalism, while The Times is known in search its vocation and funds coverage. By entente these differences, you can pick out the news portal that caters to your interests and provides you with the rumour you have a yen for to read.

Additionally, it’s worth all things local expos‚ portals because specific regions within the UK. These portals produce coverage of events and dirt stories that are akin to the area, which can be especially cooperative if you’re looking to charge of up with events in your close by community. In behalf of exemplar, local dope portals in London number the Evening Standard and the Londonist, while Manchester Evening Talk and Liverpool Echo are in demand in the North West.

Comprehensive, there are diverse statement portals readily obtainable in the UK, and it’s important to do your inspection to see the everybody that suits your needs. By means of evaluating the different low-down portals based on their coverage, luxury, and article perspective, you can select the one that provides you with the most fitting and interesting low-down stories. Esteemed success rate with your search, and I ambition this tidings helps you reveal the perfect news portal suitable you!

mexican pharmaceuticals online: mexico drug stores pharmacies – reputable mexican pharmacies online

pharmacy website india: reputable indian online pharmacy – top online pharmacy india

mexican pharmaceuticals online: buying prescription drugs in mexico online – mexican pharmaceuticals online

Anna Berezina is a honoured originator and keynoter in the deal with of psychology. With a offing in clinical luny and voluminous investigating sagacity, Anna has dedicated her calling to agreement human behavior and mental health: https://techdirt.stream/story.php?title=anna-berezina-personal-trainer-achieve-your-fitness-goals-with-expert-guidance#discuss. Middle of her between engagements, she has made impressive contributions to the battleground and has become a respected thought leader.

Anna’s judgement spans a number of areas of psychology, including cognitive screwball, unmistakable psychology, and zealous intelligence. Her comprehensive facts in these domains allows her to stock up valuable insights and strategies exchange for individuals seeking in the flesh flowering and well-being.

As an inventor, Anna has written disparate influential books that bear garnered widespread perception and praise. Her books provide practical par‘nesis and evidence-based approaches to help individuals command fulfilling lives and cultivate resilient mindsets. Away combining her clinical judgement with her passion suited for serving others, Anna’s writings drink resonated with readers roughly the world.

pharmacies in mexico that ship to usa: medicine in mexico pharmacies – mexican rx online

it’s awesome article. I look forward to the continuation.

I appreciate you sharing this blog post. Thanks Again. Cool.

https://interpharm.pro/# mexico pharmacy mail order

canadian online pharmacy – interpharm.pro They make prescription refills a breeze.

I appreciate you sharing this blog post. Thanks Again. Cool.

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

https://pharmacieenligne.icu/# Pharmacies en ligne certifiГ©es

farmacie online affidabili [url=https://farmaciaonline.men/#]п»їfarmacia online migliore[/url] farmacia online senza ricetta

We always follow your beautiful content I look forward to the continuation.

We always follow your beautiful content I look forward to the continuation.

https://farmaciaonline.men/# farmacie on line spedizione gratuita

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

There is definately a lot to find out about this subject. I like all the points you made

http://esfarmacia.men/# farmacias baratas online envГo gratis

comprare farmaci online all’estero: cialis generico miglior prezzo – farmacie online affidabili

http://esfarmacia.men/# farmacia online envГo gratis

Acheter mГ©dicaments sans ordonnance sur internet: Pharmacie en ligne sans ordonnance

canadian pharmacy ltd: reputable canadian pharmacy – onlinepharmaciescanada com

indian pharmacy paypal: india pharmacy mail order – buy prescription drugs from india

Their global medical liaisons ensure top-quality care. top 10 online pharmacy in india: best india pharmacy – indian pharmacy

best online pharmacies in mexico: buying prescription drugs in mexico – reputable mexican pharmacies online

Anna Berezina is a highly talented and famend artist, identified for her distinctive and charming artworks that never fail to leave a lasting impression. Her paintings superbly showcase mesmerizing landscapes and vibrant nature scenes, transporting viewers to enchanting worlds filled with awe and marvel.

What sets [url=https://w1000w.com/wp-content/pages/anna-berezina_123.html]Anna[/url] apart is her distinctive attention to detail and her remarkable mastery of colour. Each stroke of her brush is deliberate and purposeful, creating depth and dimension that deliver her work to life. Her meticulous strategy to capturing the essence of her topics allows her to create really breathtaking artistic endeavors.

Anna finds inspiration in her travels and the beauty of the natural world. She has a deep appreciation for the awe-inspiring landscapes she encounters, and that is evident in her work. Whether it is a serene seashore at sunset, an imposing mountain range, or a peaceful forest filled with vibrant foliage, Anna has a outstanding capacity to capture the essence and spirit of these places.

With a novel inventive fashion that mixes elements of realism and impressionism, Anna’s work is a visible feast for the eyes. Her paintings are a harmonious blend of precise details and soft, dreamlike brushstrokes. This fusion creates a captivating visual experience that transports viewers into a world of tranquility and wonder.

Anna’s expertise and creative imaginative and prescient have earned her recognition and acclaim in the art world. Her work has been exhibited in prestigious galleries across the globe, attracting the eye of art fanatics and collectors alike. Each of her items has a method of resonating with viewers on a deeply private degree, evoking emotions and sparking a sense of connection with the natural world.

As Anna continues to create stunning artworks, she leaves an indelible mark on the world of art. Her capacity to capture the wonder and essence of nature is truly outstanding, and her paintings function a testomony to her creative prowess and unwavering ardour for her craft. Anna Berezina is an artist whose work will continue to captivate and encourage for years to come..

They bridge the gap between countries with their service. indian pharmacy online: buy prescription drugs from india – indian pharmacy

best online pharmacies in mexico: mexico drug stores pharmacies – buying prescription drugs in mexico

purple pharmacy mexico price list: mexican pharmaceuticals online – purple pharmacy mexico price list

They have an impressive roster of international certifications. buying prescription drugs in mexico online: mexico drug stores pharmacies – mexican mail order pharmacies

mexico drug stores pharmacies: п»їbest mexican online pharmacies – mexico drug stores pharmacies

canadian pharmacy victoza: thecanadianpharmacy – canadian drug pharmacy

Top 100 Searched Drugs. canada pharmacy online legit: safe reliable canadian pharmacy – canada pharmacy 24h

best online pharmacies in mexico: best online pharmacies in mexico – buying prescription drugs in mexico

They provide access to global brands that are hard to find locally. indian pharmacy online: indianpharmacy com – reputable indian pharmacies

safe online pharmacies in canada: best canadian pharmacy online – canadian online drugstore

mexico drug stores pharmacies: buying from online mexican pharmacy – mexico drug stores pharmacies

Been relying on them for years, and they never disappoint. pharmacies in mexico that ship to usa: reputable mexican pharmacies online – mexican online pharmacies prescription drugs

What side effects can this medication cause? https://doxycyclineotc.store/# doxycycline cost australia

can i buy doxycycline over the counter in europe [url=https://doxycyclineotc.store/#]Doxycycline 100mg buy online[/url] buy doxycycline 500mg

Trust and reliability on a global scale. https://doxycyclineotc.store/# doxycycline 250 mg

Their staff is always eager to help and assist. https://azithromycinotc.store/# generic zithromax india

Always a step ahead in international healthcare trends. medicine for erectile: cheap ed drugs – online ed medications

doxycycline buy [url=http://doxycyclineotc.store/#]buy doxycycline online[/url] doxycycline 100 mg price uk

They understand the intricacies of international drug regulations. https://edpillsotc.store/# erectile dysfunction drugs

Бурение скважин сверху водичку – это процесс твари отверстий в течение нашей планете для допуска к подземным водным ресурсам. Этто важная процедура чтобы получения пресной воды – http://note.pearltrees.com/15164159/666765bc6f376f5e45f3fe02d21faee6. Эмпайр производится специализированными компаниями раз-два внедрением специального оборудования. Перед почином бурения прочерчивается геологическое и гидрогеологическое исследование для дефиниции пункта бурения. Скважина энергоустановка проходит на планету, творя отверстие. Через некоторое время преимущества водоносного круга щель обсаживается особенными трубами. Прочерчивается электроиспытание сверху водичку, (а) также на случае успеха скважина снабжается насосом чтобы извлечения воды. Эмпайр скважин сверху водичку спрашивает особых знаний и эксперимента, что-что тоже следование общепризнанных мерок и верховодил чтобы безопасности а также действенности процесса.

http://edpillsotc.store/# top rated ed pills

Their international catalog is expansive. https://azithromycinotc.store/# zithromax

They have strong partnerships with pharmacies around the world. https://indianpharmacy.life/# cheapest online pharmacy india

Leading with compassion on a global scale. https://drugsotc.pro/# canada pharmacy

Trustworthy and reliable, every single visit. https://mexicanpharmacy.site/# mexican drugstore online

Love the seasonal health tips they offer. https://indianpharmacy.life/# online pharmacy india

They always keep my medication history well-organized. http://drugsotc.pro/# online pharmacy indonesia

legit canadian pharmacy online [url=http://drugsotc.pro/#]canadian pharmacy meds[/url] viagra canadian pharmacy vipps approved

Every international delivery is prompt and secure. http://mexicanpharmacy.site/# п»їbest mexican online pharmacies

canadian pharmacy 24h com [url=https://drugsotc.pro/#]generic pharmacy online[/url] trusted online pharmacy reviews

Thank you for great article. I look forward to the continuation. newsmax news online

neurontin 300 mg: neurontin 100mg – neurontin 300 600 mg

buying prescription drugs in mexico online : mexico pharmacy price list – buying prescription drugs in mexico

A trusted partner for patients worldwide. https://mexicanpharmonline.com/# buying from online mexican pharmacy

mexico drug stores pharmacies [url=https://mexicanpharmonline.shop/#]mexican pharmacy[/url] mexican drugstore online

reputable mexican pharmacies online : medicines mexico – purple pharmacy mexico price list

They always offer alternatives and suggestions. http://mexicanpharmonline.shop/# mexican border pharmacies shipping to usa

mexican online pharmacies prescription drugs [url=https://mexicanpharmonline.com/#]mexico pharmacy[/url] best online pharmacies in mexico

pharmacies in mexico that ship to usa – mexico online pharmacy – purple pharmacy mexico price list

п»їbest mexican online pharmacies : medicines mexico – buying prescription drugs in mexico

Love their spacious and well-lit premises. https://mexicanpharmonline.com/# buying from online mexican pharmacy

mexico drug stores pharmacies [url=http://mexicanpharmonline.com/#]mexican pharmacy[/url] mexican mail order pharmacies

https://canadapharmacy24.pro/# buying drugs from canada

stromectol usa: buy ivermectin canada – stromectol order online

reputable canadian pharmacy: canadian pharmacy pro – canadadrugpharmacy com

https://indiapharmacy24.pro/# indian pharmacy online

reputable indian pharmacies: indian pharmacy paypal – indian pharmacies safe

http://indiapharmacy24.pro/# world pharmacy india

https://stromectol24.pro/# ivermectin cost canada

stromectol cream: buy ivermectin canada – minocycline medication

http://mobic.icu/# can i get generic mobic

I think the admin of this site is really working hard for his website since here every stuff is quality based data.

Dear immortals, I need some wow gold inspiration to create.

http://mobic.icu/# mobic price

clopidogrel bisulfate 75 mg: clopidogrel bisulfate 75 mg – buy clopidogrel online

ivermectin gel: stromectol 6 mg tablet – stromectol tablets 3 mg

http://mobic.icu/# where to buy mobic

how to get cheap mobic: cheap meloxicam – where to get generic mobic price

http://paxlovid.bid/# paxlovid buy

Buy Vardenafil 20mg online: Levitra 20 mg for sale – Buy Levitra 20mg online

https://cialis.foundation/# Tadalafil Tablet

buy viagra here [url=http://viagra.eus/#]Buy Viagra online cheap[/url] Buy Viagra online cheap

http://viagra.eus/# buy viagra here

https://kamagra.icu/# buy Kamagra

https://cialis.foundation/# Buy Tadalafil 20mg

Cialis without a doctor prescription [url=http://cialis.foundation/#]Cialis 20mg price in USA[/url] Buy Tadalafil 5mg

http://viagra.eus/# buy Viagra over the counter

over the counter sildenafil [url=http://viagra.eus/#]Cheap generic Viagra[/url] Sildenafil Citrate Tablets 100mg

https://levitra.eus/# Levitra 20 mg for sale

Cheap generic Viagra [url=http://viagra.eus/#]Cheapest Sildenafil online[/url] best price for viagra 100mg

https://kamagra.icu/# Kamagra 100mg price

https://kamagra.icu/# super kamagra

https://levitra.eus/# buy Levitra over the counter

Cialis 20mg price [url=https://cialis.foundation/#]Buy Tadalafil 20mg[/url] Cialis 20mg price in USA

https://viagra.eus/# best price for viagra 100mg

cialis for sale [url=https://cialis.foundation/#]Cheap Cialis[/url] Cialis 20mg price

Cheap Levitra online [url=https://levitra.eus/#]Cheap Levitra online[/url] Levitra 10 mg buy online

top online pharmacy india: top online pharmacy india – world pharmacy india indiapharmacy.pro

india pharmacy [url=https://indiapharmacy.pro/#]buy medicines online in india[/url] top 10 online pharmacy in india indiapharmacy.pro

https://canadapharmacy.guru/# legit canadian pharmacy online canadapharmacy.guru

https://indiapharmacy.pro/# buy medicines online in india indiapharmacy.pro

reputable mexican pharmacies online: mexican mail order pharmacies – medicine in mexico pharmacies mexicanpharmacy.company

pharmacy canadian: legit canadian pharmacy – canadapharmacyonline legit canadapharmacy.guru

buy medicines online in india: best online pharmacy india – india pharmacy mail order indiapharmacy.pro

buy drugs from canada [url=http://canadapharmacy.guru/#]pharmacy com canada[/url] canadian pharmacy review canadapharmacy.guru

buying from online mexican pharmacy: mexican border pharmacies shipping to usa – п»їbest mexican online pharmacies mexicanpharmacy.company

best online pharmacy india: best online pharmacy india – top online pharmacy india indiapharmacy.pro

canada pharmacy reviews [url=https://canadapharmacy.guru/#]pharmacy in canada[/url] pharmacy rx world canada canadapharmacy.guru

https://canadapharmacy.guru/# canadian pharmacy world canadapharmacy.guru

A big thank you for your blog.Really looking forward to read more. Want more.

top 10 pharmacies in india: indian pharmacy online – indian pharmacy indiapharmacy.pro

online pharmacy india: mail order pharmacy india – top 10 pharmacies in india indiapharmacy.pro

buying from online mexican pharmacy [url=https://mexicanpharmacy.company/#]best online pharmacies in mexico[/url] mexican online pharmacies prescription drugs mexicanpharmacy.company

india pharmacy: cheapest online pharmacy india – indian pharmacy indiapharmacy.pro

buying prescription drugs in mexico online: medication from mexico pharmacy – reputable mexican pharmacies online mexicanpharmacy.company

canadianpharmacymeds com [url=http://canadapharmacy.guru/#]canadian pharmacy[/url] best canadian online pharmacy canadapharmacy.guru

canadian pharmacies online: ed drugs online from canada – pharmacies in canada that ship to the us canadapharmacy.guru

http://canadapharmacy.guru/# canada drug pharmacy canadapharmacy.guru

india pharmacy: india pharmacy mail order – top 10 pharmacies in india indiapharmacy.pro

https://mexicanpharmacy.company/# mexican drugstore online mexicanpharmacy.company

mexican online pharmacies prescription drugs: п»їbest mexican online pharmacies – mexican border pharmacies shipping to usa mexicanpharmacy.company

mexican mail order pharmacies [url=https://mexicanpharmacy.company/#]purple pharmacy mexico price list[/url] purple pharmacy mexico price list mexicanpharmacy.company

canadian pharmacy meds: canadian neighbor pharmacy – canadian discount pharmacy canadapharmacy.guru

world pharmacy india: buy prescription drugs from india – reputable indian pharmacies indiapharmacy.pro

online pharmacy india [url=http://indiapharmacy.pro/#]indian pharmacies safe[/url] world pharmacy india indiapharmacy.pro

https://mexicanpharmacy.company/# pharmacies in mexico that ship to usa mexicanpharmacy.company

india pharmacy mail order: top 10 online pharmacy in india – indian pharmacy paypal indiapharmacy.pro

cheap canadian pharmacy online: trusted canadian pharmacy – legitimate canadian online pharmacies canadapharmacy.guru

reliable canadian pharmacy reviews [url=http://canadapharmacy.guru/#]canadian pharmacy victoza[/url] onlinecanadianpharmacy canadapharmacy.guru

mail order pharmacy india: Online medicine order – buy medicines online in india indiapharmacy.pro

very informative articles or reviews at this time.

online shopping pharmacy india: world pharmacy india – top online pharmacy india indiapharmacy.pro

best india pharmacy: india pharmacy – online pharmacy india indiapharmacy.pro

top 10 pharmacies in india [url=https://indiapharmacy.pro/#]top 10 pharmacies in india[/url] indian pharmacy online indiapharmacy.pro

http://canadapharmacy.guru/# legitimate canadian pharmacy online canadapharmacy.guru

http://canadapharmacy.guru/# canadian pharmacy 24 com canadapharmacy.guru

top 10 pharmacies in india: indian pharmacy online – mail order pharmacy india indiapharmacy.pro

mexican rx online: mexican online pharmacies prescription drugs – buying prescription drugs in mexico online mexicanpharmacy.company

canadian online drugs: canadian pharmacy online ship to usa – canadian drugs online canadapharmacy.guru

п»їlegitimate online pharmacies india [url=http://indiapharmacy.pro/#]indian pharmacies safe[/url] best india pharmacy indiapharmacy.pro

https://mexicanpharmacy.company/# medicine in mexico pharmacies mexicanpharmacy.company

canadian pharmacy india: mail order pharmacy india – top 10 pharmacies in india indiapharmacy.pro

buying from online mexican pharmacy [url=https://mexicanpharmacy.company/#]mexican rx online[/url] best online pharmacies in mexico mexicanpharmacy.company

canada drug pharmacy: canadian medications – canada cloud pharmacy canadapharmacy.guru

https://indiapharmacy.pro/# reputable indian pharmacies indiapharmacy.pro

https://indiapharmacy.pro/# top online pharmacy india indiapharmacy.pro

canada drugs online reviews: canadian world pharmacy – canadian online pharmacy canadapharmacy.guru

buying prescription drugs in mexico [url=http://mexicanpharmacy.company/#]purple pharmacy mexico price list[/url] medication from mexico pharmacy mexicanpharmacy.company

https://mexicanpharmacy.company/# mexican online pharmacies prescription drugs mexicanpharmacy.company

best online pharmacies in mexico: mexican mail order pharmacies – medicine in mexico pharmacies mexicanpharmacy.company

I like the efforts you have put in this regards for all the great content. Watch خبر bbc

can you get clomid without prescription: get cheap clomid online – generic clomid pill

https://propecia.sbs/# buy cheap propecia no prescription

buy doxycycline online [url=https://doxycycline.sbs/#]odering doxycycline[/url] doxycycline vibramycin

https://propecia.sbs/# cheap propecia without insurance

1250 mg prednisone: prednisone 10mg tabs – cheap prednisone 20 mg

https://propecia.sbs/# get propecia without rx

buy doxycycline 100mg [url=http://doxycycline.sbs/#]100mg doxycycline[/url] doxycycline generic

For the reason that the admin of this site is working no uncertainty very quickly it will be renowned due to its quality contents.

buy doxycycline online 270 tabs: doxycycline hyclate – cheap doxycycline online

prednisone 20mg: prednisone 5mg capsules – prednisone 2 mg

buying propecia without insurance: buy cheap propecia for sale – buy cheap propecia online

buy doxycycline online: where can i get doxycycline – doxycycline hyc 100mg

doxycycline vibramycin: doxycycline 150 mg – doxycycline online

http://amoxil.world/# amoxicillin tablets in india

http://prednisone.digital/# buy prednisone online no script

prednisone prescription online [url=http://prednisone.digital/#]prednisone 50 mg tablet canada[/url] purchase prednisone from india

doxycycline 100 mg: doxycycline 150 mg – 100mg doxycycline

http://amoxil.world/# amoxicillin 500mg price canada

https://prednisone.digital/# over the counter prednisone medicine

prednisone prescription online [url=http://prednisone.digital/#]prednisone uk over the counter[/url] prednisone price canada

cost cheap propecia without insurance: generic propecia pills – order generic propecia without insurance

https://clomid.sbs/# where to buy generic clomid without rx

https://doxycycline.sbs/# doxycycline pills

cheap doxycycline online [url=https://doxycycline.sbs/#]doxycycline 200 mg[/url] buy doxycycline online

where to get cheap clomid without a prescription: cost clomid without rx – cost of generic clomid without dr prescription

https://prednisone.digital/# prednisone prescription online

https://doxycycline.sbs/# doxycycline 100mg price

can i buy clomid online [url=https://clomid.sbs/#]can i purchase cheap clomid without a prescription[/url] cost cheap clomid no prescription

prednisone 20 mg in india: 3000mg prednisone – 50 mg prednisone canada pharmacy

http://propecia.sbs/# cost generic propecia pill

https://propecia.sbs/# propecia brand name

100mg doxycycline [url=http://doxycycline.sbs/#]generic doxycycline[/url] doxycycline 150 mg

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

I appreciate you sharing this blog post. Thanks Again. Cool.

https://edpills.icu/# ed pills for sale

mexican mail order pharmacies [url=https://mexicopharm.shop/#]mexican online pharmacies prescription drugs[/url] buying prescription drugs in mexico online

https://indiapharm.guru/# top online pharmacy india

prescription drugs canada buy online: canadian pharmacy mall – reddit canadian pharmacy

https://mexicopharm.shop/# reputable mexican pharmacies online

mexico drug stores pharmacies [url=https://mexicopharm.shop/#]medicine in mexico pharmacies[/url] mexican pharmaceuticals online

http://mexicopharm.shop/# mexican border pharmacies shipping to usa

ed pills that really work: best erectile dysfunction pills – impotence pills

https://indiapharm.guru/# п»їlegitimate online pharmacies india

pharmacies in mexico that ship to usa [url=https://mexicopharm.shop/#]mexican rx online[/url] mexican border pharmacies shipping to usa

https://mexicopharm.shop/# mexican border pharmacies shipping to usa

pharmacy com canada: canadian pharmacy sarasota – canadian pharmacy

http://mexicopharm.shop/# medicine in mexico pharmacies

buy prescription drugs from canada [url=http://withoutprescription.guru/#]viagra without a doctor prescription walmart[/url] ed meds online without doctor prescription

http://edpills.icu/# cure ed

prescription drugs online without doctor: buy prescription drugs from india – prescription without a doctor’s prescription

http://edpills.icu/# ed medication online

mexican drugstore online [url=https://mexicopharm.shop/#]mexican online pharmacies prescription drugs[/url] buying prescription drugs in mexico

http://indiapharm.guru/# mail order pharmacy india

mexico drug stores pharmacies: medication from mexico pharmacy – mexico drug stores pharmacies

http://indiapharm.guru/# reputable indian pharmacies

global pharmacy canada [url=https://canadapharm.top/#]Accredited Canadian and International Online Pharmacies[/url] safe canadian pharmacies

can you buy amoxicillin uk: amoxicillin 500mg capsule – where to get amoxicillin over the counter

ed pills for sale: medicine for impotence – top ed pills

http://edpills.icu/# ed treatments

https://indiapharm.guru/# reputable indian pharmacies

natural ed remedies [url=http://edpills.icu/#]п»їerectile dysfunction medication[/url] best male enhancement pills

canadian pharmacy tampa: Prescription Drugs from Canada – best canadian online pharmacy

get cheap clomid no prescription: buy cheap clomid price – order generic clomid without rx

http://indiapharm.guru/# online shopping pharmacy india

https://mexicopharm.shop/# reputable mexican pharmacies online

п»їlegitimate online pharmacies india [url=http://indiapharm.guru/#]pharmacy website india[/url] cheapest online pharmacy india

mexican mail order pharmacies: mexican pharmaceuticals online – buying prescription drugs in mexico online

buy prescription drugs online: 100mg viagra without a doctor prescription – prescription drugs online without

http://tadalafil.trade/# buy tadalafil 10mg india

ed pills comparison: erection pills – ed medications list

http://tadalafil.trade/# buy tadalafil over the counter

п»їkamagra [url=https://kamagra.team/#]Kamagra 100mg price[/url] Kamagra tablets

Kamagra 100mg price: Kamagra tablets – Kamagra Oral Jelly

http://tadalafil.trade/# generic tadalafil 10mg

generic tadalafil without prescription [url=https://tadalafil.trade/#]generic tadalafil medication[/url] tadalafil online paypal

sildenafil lowest price: where to buy generic sildenafil – buy 90 sildenafil 100mg price

http://sildenafil.win/# sildenafil 100mg australia

best ed medications: ed medications list – ed pills that really work

generic tadalafil medication [url=http://tadalafil.trade/#]how much is tadalafil[/url] tadalafil 2.5 mg price

https://levitra.icu/# Buy Vardenafil 20mg online

cures for ed: ed medications – natural ed remedies

Generic Levitra 20mg [url=https://levitra.icu/#]Cheap Levitra online[/url] Buy Levitra 20mg online

https://edpills.monster/# medicine for impotence

buy sildenafil online: sildenafil 20mg brand name – how much is sildenafil in canada

http://edpills.monster/# top erection pills

best ed pills: erectile dysfunction drugs – best over the counter ed pills

sildenafil 50mg best price [url=https://sildenafil.win/#]where can i get sildenafil without prescription[/url] sildenafil 40 mg

amoxicillin 500mg: amoxicillin 500mg prescription – amoxicillin over the counter in canada

https://lisinopril.auction/# zestoretic 20 25

lisinopril 3 [url=https://lisinopril.auction/#]prescription for lisinopril[/url] lisinopril 15mg

buy cipro: buy ciprofloxacin over the counter – ciprofloxacin order online

http://ciprofloxacin.men/# ciprofloxacin mail online

SightCare is a powerful formula that supports healthy eyes the natural way. It is specifically designed for both men and women who are suffering from poor eyesight.

where can you buy zithromax: buy zithromax canada – zithromax antibiotic without prescription

3 lisinopril [url=https://lisinopril.auction/#]zestril 20 mg tablet[/url] lisinopril 10 mg online no prescription

doxycycline 50 mg cost: doxycycline buy online – where to buy doxycycline in singapore

http://azithromycin.bar/# buy azithromycin zithromax

doxycycline 100mg best buy: Buy doxycycline hyclate – can i buy doxycycline over the counter

buy ciprofloxacin over the counter [url=https://ciprofloxacin.men/#]buy ciprofloxacin online[/url] buy cipro online without prescription

http://ciprofloxacin.men/# where to buy cipro online

lisinopril over the counter: Over the counter lisinopril – lisinopril australia

lisinopril 40 mg tablets: buy lisinopril – lisinopril 40 mg india

п»їcipro generic [url=http://ciprofloxacin.men/#]buy ciprofloxacin over the counter[/url] buy cipro online without prescription

http://azithromycin.bar/# zithromax capsules australia

can you buy zithromax over the counter in mexico: zithromax antibiotic without prescription – zithromax price canada

amoxicillin without rx [url=http://amoxicillin.best/#]purchase amoxicillin online[/url] amoxicillin 500 mg tablets

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

I do not even understand how I ended up here but I assumed this publish used to be great

http://ciprofloxacin.men/# where to buy cipro online

price of amoxicillin without insurance: where can i buy amoxicillin over the counter – amoxicillin price canada

can you buy zithromax online: buy zithromax – purchase zithromax z-pak

canadian drug [url=http://canadiandrugs.store/#]certified canadian pharmacy[/url] canadian pharmacy world reviews

http://mexicopharmacy.store/# mexican pharmaceuticals online

reliable canadian pharmacy: trust canadian pharmacy – canadian world pharmacy

no prior prescription required pharmacy: Top mail order pharmacies – get canadian drugs

https://indiapharmacy.site/# buy medicines online in india

my canadian pharmacy: canadian pharmacy – cheapest pharmacy canada

canadian pharmacy 365: safe online pharmacy – canadian drug pharmacy

prescription drug discounts [url=https://ordermedicationonline.pro/#]cheapest online pharmacy[/url] best online pharmacies canada

https://mexicopharmacy.store/# medication from mexico pharmacy

drug stores canada: online meds – canada medications

canada prescriptions online: online pharmacy no prescription – cheap viagra online canadian pharmacy

Boostaro is a natural health formula for men that aims to improve health.

http://claritin.icu/# ventolin online uk

ventolin order online without prescription [url=https://claritin.icu/#]Ventolin inhaler[/url] ventolin on line

http://clomid.club/# where buy clomid without dr prescription

Buy Actiflow 78% off USA (Official). Actiflow is a natural and effective leader in prostate health supplements

GlucoTrust 75% off for sale. GlucoTrust is a dietary supplement that has been designed to support healthy blood sugar levels and promote weight loss in a natural way.

ErecPrime is a natural male dietary supsplement designed to enhance performance and overall vitality.

Amiclear is a powerful supplement that claims to reduce blood sugar levels and help people suffering from diabetes.

Cortexi is a natural hearing support aid that has been used by thousands of people around the globe.

Dentitox Pro is an All-Natural Liquid Oral Hygiene Supplement Consists Unique Combination Of Vitamins And Plant Extracts To Support The Health Of Gums

Quietum Plus is a 100% natural supplement designed to address ear ringing and other hearing issues. This formula uses only the best in class and natural ingredients to achieve desired results.

ventolin uk pharmacy: buy Ventolin inhaler – generic ventolin inhaler

Introducing Claritox Pro, a natural supplement designed to help you maintain your balance and prevent dizziness.

PuraVive is a natural supplement that supports weight loss naturally. The supplement is created using the secrets of weight loss straight from Hollywood.

EndoPeak is a natural energy-boosting formula designed to improve men’s stamina, energy levels, and overall health.

http://clomid.club/# can you buy clomid without a prescription

Fast Lean Pro is a herbal supplement that tricks your brain into imagining that you’re fasting and helps you maintain a healthy weight no matter when or what you eat.

neurontin 400 mg: generic gabapentin – neurontin 800 mg pill

GlucoTru Diabetes Supplement is a natural blend of various natural components.

Eye Fortin is a dietary supplement in the form of liquid that can help you maintain strong eyesight well into old age.

https://wellbutrin.rest/# wellbutrin 75 mg daily

Buy Metanail Serum Pro USA official website. Say goodbye to nail and foot woes and hello to healthy, happy hands and feet with Metanail Serum Pro

can i buy ventolin over the counter in usa: Ventolin inhaler online – ventolin prescription online

paxlovid http://paxlovid.club/# paxlovid pill

As we age, our skin undergoes various changes, including the loss of elasticity, appearance of fine lines and wrinkles, and uneven skin tone.

Nervogen Pro™ Scientifically Proven Ingredients That Can End Your Nerve Pain in Short Time.

NeuroPure is a breakthrough dietary formula designed to alleviate neuropathy, a condition that affects a significant number of individuals with diabetes.

Buy neurodrine memory supplement (Official). The simplest way to maintain a steel trap memory

NeuroRise™ is one of the popular and best tinnitus supplements that help you experience 360-degree hearing

http://wellbutrin.rest/# wellbutrin prescription

neurontin 2400 mg: gabapentin best price – buy brand neurontin

ProDentim is an innovative dental health supplement that boasts of a unique blend of 3.5 billion probiotics and essential nutrients

Prostadine is a unique supplement for men’s prostate health. It’s made to take care of your prostate as you grow older.

http://clomid.club/# can i buy generic clomid without rx

Protoflow supports the normal functions of the bladder, prostate and reproductive system.

ProvaSlim™ is a weight loss formula designed to optimize metabolic activity and detoxify the body. It specifically targets metabolic dysfunction

SeroLean is a nutritional supplement developed by Dr. Robert Posner to help anyone easily lose weight.

how much is neurontin pills: buy gabapentin – ordering neurontin online

VidaCalm is an herbal supplement that claims to permanently silence tinnitus.

Alpha Tonic daily testosterone booster for energy and performance. Convenient powder form ensures easy blending into drinks for optimal absorption.

http://clomid.club/# buying clomid

SonoFit is a revolutionary hearing support supplement that is designed to offer a natural and effective solution to support hearing.

SonoVive™ is a 100% natural hearing supplement by Sam Olsen made with powerful ingredients that help heal tinnitus problems and restore your hearing.

TonicGreens is a revolutionary product that can transform your health and strengthen your immune system!

ProstateFlux™ is a natural supplement designed by experts to protect prostate health without interfering with other body functions.

Tropislim, is an all-natural dietary supplement. It promotes healthy weight loss through a proprietary blend of tropical plants and nutrients.

Pineal XT™ is a dietary supplement crafted from entirely organic ingredients, ensuring a natural formulation.

neurontin uk: generic neurontin cost – neurontin 600 mg capsule

https://claritin.icu/# generic ventolin price

farmacia online senza ricetta: farmacia online più conveniente – farmacia online miglior prezzo

farmaci senza ricetta elenco [url=http://avanafilit.icu/#]avanafil spedra[/url] farmacie online sicure

acquisto farmaci con ricetta: farmacia online più conveniente – farmaci senza ricetta elenco

BioVanish is a supplement from WellMe that helps consumers improve their weight loss by transitioning to ketosis.

comprare farmaci online all’estero: comprare avanafil senza ricetta – comprare farmaci online all’estero

GlucoBerry is a unique supplement that offers an easy and effective way to support balanced blood sugar levels.

acquistare farmaci senza ricetta: avanafil – farmacie online sicure

Joint Genesis is a supplement from BioDynamix that helps consumers to improve their joint health to reduce pain.

BioFit is a natural supplement that balances good gut bacteria, essential for weight loss and overall health.

MenoRescue™ is a women’s health dietary supplement formulated to assist them in overcoming menopausal symptoms.

https://avanafilit.icu/# migliori farmacie online 2023

farmacie online autorizzate elenco: kamagra gold – farmacie online affidabili

migliori farmacie online 2023 [url=http://kamagrait.club/#]kamagra gel[/url] farmaci senza ricetta elenco

comprare farmaci online all’estero: kamagra – farmacia online miglior prezzo

comprare farmaci online all’estero: farmacia online – farmacie online sicure

acquistare farmaci senza ricetta: kamagra gel – comprare farmaci online all’estero

acquistare farmaci senza ricetta: Farmacie che vendono Cialis senza ricetta – farmacie online sicure

https://tadalafilit.store/# farmacia online piГ№ conveniente

farmacie online autorizzate elenco: avanafil spedra – farmacia online

cerco viagra a buon prezzo: alternativa al viagra senza ricetta in farmacia – alternativa al viagra senza ricetta in farmacia

farmacia online migliore: dove acquistare cialis online sicuro – farmacia online

farmacia online migliore: dove acquistare cialis online sicuro – farmacia online senza ricetta

Amiclear is a blood sugar support formula that’s perfect for men and women in their 30s, 40s, 50s, and even 70s.

SharpEar™ is a 100% natural ear care supplement created by Sam Olsen that helps to fix hearing loss

farmacia online miglior prezzo: kamagra gold – comprare farmaci online all’estero

farmacia online miglior prezzo: avanafil generico prezzo – comprare farmaci online all’estero

http://avanafilit.icu/# acquisto farmaci con ricetta

ortexi is a 360° hearing support designed for men and women who have experienced hearing loss at some point in their lives.

viagra 100 mg prezzo in farmacia: sildenafil 100mg prezzo – viagra ordine telefonico

gel per erezione in farmacia [url=https://sildenafilit.bid/#]viagra senza ricetta[/url] viagra generico in farmacia costo

comprare farmaci online con ricetta: farmacia online spedizione gratuita – migliori farmacie online 2023

farmacia online: kamagra oral jelly consegna 24 ore – comprare farmaci online all’estero

farmacia online senza ricetta: farmacia online migliore – farmacie on line spedizione gratuita

farmacia online migliore: avanafil prezzo – farmacie online affidabili

viagra cosa serve: viagra senza ricetta – pillole per erezione in farmacia senza ricetta

https://farmaciait.pro/# farmacia online piГ№ conveniente

farmacie online autorizzate elenco [url=http://kamagrait.club/#]kamagra[/url] farmacia online migliore

acquisto farmaci con ricetta: dove acquistare cialis online sicuro – farmacia online senza ricetta

viagra online consegna rapida: sildenafil 100mg prezzo – le migliori pillole per l’erezione

farmacia online miglior prezzo: Tadalafil prezzo – top farmacia online

acquisto farmaci con ricetta: kamagra oral jelly – farmaci senza ricetta elenco

In the early days of crypto, many wealthy cryptocurrency investors purchased Lamborghinis as a status symbol to prove their success in the market. Following that, Lamborghinis became synonymous with a crypto’s success, with many people in the community using the crypto slang phrase ‘When Lambo?’ to ask when a crypto investment will be worth enough to buy a Lamborghini. China banned trading in bitcoin, with first steps taken in September 2017, and a complete ban that started on 1 February 2018. Bitcoin prices then fell from $9,052 to $6,914 on 5 February 2018. The percentage of bitcoin trading in the Chinese renminbi fell from over 90% in September 2017 to less than 1% in June 2018. Note: We have 250 other definitions for BTC in our Acronym Attic

http://www.field-holdings.co.kr/g5/bbs/board.php?bo_table=free&wr_id=1099415

© 2023 Bitcoinist. All Rights Reserved. MANA, which is the native token of the network and the main currency in the Decentraland marketplace, has a limited supply and every time someone buys LAND with MANA, a percentage of MANA tokens is burned. MANA tokens have no use outside the Decentraland ecosystem other than being traded in the crypto market for a profit. While Bitcoin is classified as a commodity by U.S. regulators, SEC Chair Gary Gensler has long asserted that most other tokens fall under the agency’s investor-protection laws. Gensler advocates for trading platforms to register with the SEC, signaling a stricter stance on cryptocurrencies. The labeling of specific tokens as unregistered securities represents a tougher approach as regulators crack down on digital assets, following a challenging 2022 and notable incidents such as the FTX exchange’s bankruptcy.

cerco viagra a buon prezzo: viagra senza ricetta – viagra acquisto in contrassegno in italia

farmacie online affidabili [url=https://tadalafilit.store/#]cialis prezzo[/url] acquistare farmaci senza ricetta

farmacia online senza ricetta: avanafil prezzo – farmacia online più conveniente

farmacia online senza ricetta: farmacia online piГ№ conveniente – farmacie on line spedizione gratuita

https://avanafilit.icu/# acquisto farmaci con ricetta

farmaci senza ricetta elenco: Avanafil farmaco – farmacia online migliore

farmacia online più conveniente: avanafil generico prezzo – comprare farmaci online con ricetta

farmaci senza ricetta elenco: kamagra gel prezzo – farmacie on line spedizione gratuita

farmacia online senza ricetta [url=http://kamagrait.club/#]kamagra gel prezzo[/url] comprare farmaci online all’estero

farmacia online migliore: farmacia online più conveniente – farmacia online miglior prezzo

https://vardenafilo.icu/# farmacias baratas online envÃo gratis

farmacia envГos internacionales: Levitra sin receta – farmacia online barata

http://kamagraes.site/# farmacia 24h

https://kamagraes.site/# farmacia online barata

farmacia online madrid [url=https://farmacia.best/#]farmacia online envio gratis[/url] farmacias online seguras

http://sildenafilo.store/# п»їViagra online cerca de Madrid

http://sildenafilo.store/# comprar viagra online en andorra

https://sildenafilo.store/# se puede comprar viagra sin receta

sildenafilo 100mg precio farmacia: comprar viagra – comprar sildenafilo cinfa 100 mg espaГ±a

https://farmacia.best/# farmacia barata

http://farmacia.best/# farmacia online madrid

https://tadalafilo.pro/# farmacia envÃos internacionales

farmacia online madrid [url=http://kamagraes.site/#]kamagra oral jelly[/url] farmacia online 24 horas

http://sildenafilo.store/# comprar viagra en españa amazon

http://kamagraes.site/# farmacia online internacional

farmacia 24h: kamagra gel – farmacia online barata

http://sildenafilo.store/# viagra online rápida

https://kamagraes.site/# п»їfarmacia online

farmacias baratas online envГo gratis [url=http://vardenafilo.icu/#]Levitra sin receta[/url] farmacias online baratas

comprar sildenafilo cinfa 100 mg espaГ±a: sildenafilo precio – sildenafilo cinfa 100 mg precio farmacia

https://kamagraes.site/# farmacia online 24 horas

http://sildenafilo.store/# viagra para mujeres

http://kamagraes.site/# farmacia online madrid

http://kamagraes.site/# farmacia barata

http://tadalafilo.pro/# п»їfarmacia online

comprar viagra en espaГ±a envio urgente contrareembolso [url=http://sildenafilo.store/#]viagra precio[/url] farmacia gibraltar online viagra

https://sildenafilo.store/# comprar viagra en españa envio urgente

farmacia online envГo gratis: vardenafilo sin receta – farmacia online barata

http://kamagraes.site/# farmacia online

https://farmacia.best/# farmacia 24h

https://vardenafilo.icu/# farmacias baratas online envÃo gratis

http://farmacia.best/# farmacia online

https://sildenafilo.store/# comprar sildenafilo cinfa 100 mg espaГ±a

farmacia online madrid: Comprar Levitra Sin Receta En Espana – farmacias online seguras en espaГ±a

https://tadalafilo.pro/# farmacia online

farmacia barata [url=http://vardenafilo.icu/#]vardenafilo[/url] farmacias online baratas

http://kamagraes.site/# farmacias baratas online envÃo gratis

http://tadalafilo.pro/# farmacia online barata

http://kamagraes.site/# farmacias online baratas

viagra online cerca de la coruГ±a: comprar viagra en espana – viagra para mujeres

https://vardenafilo.icu/# farmacia online 24 horas

http://vardenafilo.icu/# farmacia online 24 horas

http://farmacia.best/# farmacias online baratas

https://sildenafilo.store/# Viagra online cerca de Madrid

farmacia online 24 horas [url=https://kamagraes.site/#]kamagra jelly[/url] farmacia online internacional

farmacias baratas online envГo gratis: cialis en Espana sin receta contrareembolso – farmacias online seguras en espaГ±a

http://tadalafilo.pro/# farmacia barata

https://kamagraes.site/# farmacia online internacional

http://vardenafilo.icu/# farmacia online internacional

http://farmacia.best/# farmacia barata

farmacia online envГo gratis: kamagra gel – farmacias online seguras

http://tadalafilo.pro/# farmacias online seguras

https://sildenafilo.store/# viagra 100 mg precio en farmacias

http://farmacia.best/# farmacia online madrid

https://vardenafilo.icu/# farmacia online envÃo gratis

http://farmacia.best/# farmacias online seguras en españa

farmacia online 24 horas: Cialis sin receta – farmacias online baratas

farmacia online madrid [url=http://vardenafilo.icu/#]Levitra Bayer[/url] farmacia online madrid

https://vardenafilo.icu/# farmacias online seguras

http://sildenafilo.store/# comprar viagra en españa envio urgente

http://viagrasansordonnance.store/# Viagra sans ordonnance 24h suisse

farmacia online madrid: farmacia online envio gratis murcia – farmacia envГos internacionales

https://levitrafr.life/# acheter medicament a l etranger sans ordonnance

Pharmacie en ligne livraison 24h [url=http://kamagrafr.icu/#]kamagra gel[/url] Pharmacie en ligne pas cher

http://viagrasansordonnance.store/# Viagra sans ordonnance livraison 48h

Pharmacies en ligne certifiГ©es: kamagra oral jelly – Pharmacie en ligne livraison gratuite

https://cialissansordonnance.pro/# pharmacie en ligne

farmacias baratas online envГo gratis: kamagra jelly – farmacias online seguras en espaГ±a

https://cialissansordonnance.pro/# Pharmacie en ligne livraison rapide

http://levitrafr.life/# pharmacie ouverte

Pharmacie en ligne France [url=http://levitrafr.life/#]Levitra sans ordonnance 24h[/url] Pharmacie en ligne livraison gratuite

pharmacie ouverte: pharmacie en ligne – Pharmacie en ligne sans ordonnance

https://kamagrafr.icu/# acheter medicament a l etranger sans ordonnance

farmacia online 24 horas: comprar kamagra en espana – farmacia online envГo gratis

https://levitrafr.life/# Pharmacie en ligne France

http://levitrafr.life/# Pharmacie en ligne livraison 24h

https://viagrasansordonnance.store/# Acheter Sildenafil 100mg sans ordonnance

Pharmacie en ligne livraison gratuite [url=https://kamagrafr.icu/#]kamagra pas cher[/url] pharmacie ouverte 24/24

pharmacie ouverte: acheter mГ©dicaments Г l’Г©tranger – Pharmacie en ligne livraison rapide

http://levitrafr.life/# acheter medicament a l etranger sans ordonnance

farmacias online seguras en espaГ±a: farmacia online envio gratis valencia – farmacia online madrid

https://levitrafr.life/# Pharmacie en ligne pas cher

http://levitrafr.life/# Acheter médicaments sans ordonnance sur internet

http://kamagrafr.icu/# pharmacie ouverte 24/24

Pharmacie en ligne fiable [url=http://levitrafr.life/#]Levitra pharmacie en ligne[/url] pharmacie ouverte 24/24

п»їViagra sans ordonnance 24h: Acheter du Viagra sans ordonnance – Viagra sans ordonnance livraison 48h

http://levitrafr.life/# pharmacie en ligne

farmacia barata: farmacia 24 horas – farmacia online barata

http://viagrasansordonnance.store/# Acheter viagra en ligne livraison 24h

http://cialissansordonnance.pro/# pharmacie ouverte

online apotheke versandkostenfrei [url=https://cialiskaufen.pro/#]cialis generika[/url] versandapotheke versandkostenfrei

http://cialiskaufen.pro/# versandapotheke versandkostenfrei

https://kamagrakaufen.top/# internet apotheke

Viagra kaufen gГјnstig [url=https://viagrakaufen.store/#]viagra ohne rezept[/url] Viagra Generika kaufen Schweiz

https://cialiskaufen.pro/# п»їonline apotheke

https://kamagrakaufen.top/# online-apotheken

versandapotheke versandkostenfrei [url=https://apotheke.company/#]gГјnstige online apotheke[/url] versandapotheke

https://kamagrakaufen.top/# versandapotheke versandkostenfrei

http://apotheke.company/# online-apotheken

versandapotheke deutschland [url=https://cialiskaufen.pro/#]cialis generika[/url] gГјnstige online apotheke

online apotheke preisvergleich: apotheke online versandkostenfrei – online apotheke preisvergleich

https://viagrakaufen.store/# Viagra rezeptfreie Schweiz bestellen

versandapotheke deutschland [url=http://kamagrakaufen.top/#]kamagra jelly kaufen[/url] online apotheke preisvergleich

http://cialiskaufen.pro/# online-apotheken

best online pharmacies in mexico pharmacies in mexico that ship to usa mexican drugstore online

medicine in mexico pharmacies [url=https://mexicanpharmacy.cheap/#]mexican border pharmacies shipping to usa[/url] mexican online pharmacies prescription drugs

mexico pharmacies prescription drugs mexican pharmacy best mexican online pharmacies

http://mexicanpharmacy.cheap/# reputable mexican pharmacies online

http://mexicanpharmacy.cheap/# mexico pharmacies prescription drugs

mexico pharmacies prescription drugs purple pharmacy mexico price list best mexican online pharmacies

buying prescription drugs in mexico online buying prescription drugs in mexico mexico drug stores pharmacies

pharmacies in mexico that ship to usa [url=http://mexicanpharmacy.cheap/#]mexican online pharmacies prescription drugs[/url] purple pharmacy mexico price list

mexican pharmacy mexican online pharmacies prescription drugs pharmacies in mexico that ship to usa

https://mexicanpharmacy.cheap/# medication from mexico pharmacy

http://mexicanpharmacy.cheap/# best online pharmacies in mexico

mexico pharmacies prescription drugs [url=http://mexicanpharmacy.cheap/#]buying prescription drugs in mexico online[/url] mexico drug stores pharmacies

https://mexicanpharmacy.cheap/# best online pharmacies in mexico

medication from mexico pharmacy mexico pharmacies prescription drugs mexican drugstore online

pharmacies in mexico that ship to usa medication from mexico pharmacy mexico pharmacies prescription drugs

mexico drug stores pharmacies mexico drug stores pharmacies best mexican online pharmacies

https://mexicanpharmacy.cheap/# buying from online mexican pharmacy

buying from online mexican pharmacy [url=https://mexicanpharmacy.cheap/#]mexican rx online[/url] mexican rx online

purple pharmacy mexico price list mexican online pharmacies prescription drugs reputable mexican pharmacies online

best online pharmacies in mexico mexican rx online mexican mail order pharmacies

Boostaro increases blood flow to the reproductive organs, leading to stronger and more vibrant erections. It provides a powerful boost that can make you feel like you’ve unlocked the secret to firm erections

best online pharmacies in mexico medication from mexico pharmacy buying prescription drugs in mexico online

https://mexicanpharmacy.cheap/# mexico drug stores pharmacies

ErecPrime is a 100% natural supplement which is designed specifically

Puravive introduced an innovative approach to weight loss and management that set it apart from other supplements.

mexico drug stores pharmacies mexico pharmacies prescription drugs best mexican online pharmacies

pharmacies in mexico that ship to usa buying from online mexican pharmacy mexico pharmacies prescription drugs

mexican mail order pharmacies [url=http://mexicanpharmacy.cheap/#]pharmacies in mexico that ship to usa[/url] п»їbest mexican online pharmacies

buying prescription drugs in mexico mexican border pharmacies shipping to usa medication from mexico pharmacy

Эффективное изоляция фасадов — удобство и экономическая выгода в семейном здании!

Согласитесь, ваш коттедж заслуживает высококачественного! Изоляция внешних стен – не исключительно решение для сбережения на отопительных расходах, это вклад в в благополучие и долговечность вашего здания.

? Почему теплосбережение с нами-профессионалами?

Квалификация: Наша команда – квалифицированные. Мы заботимся о каждой, чтобы обеспечить вашему коттеджу идеальное теплосбережение.

Затраты теплоизоляции: Наша бригада ценим ваш бюджетные возможности. [url=https://stroystandart-kirov.ru/]Ремонт и утепление фасада дома[/url] – от 1350 руб./кв.м. Это вложение денег в ваше удобное будущее!

Энергосбережение: Забудьте о термопотерях! Наши не только сохраняют тепловую атмосферу, но и дарят вашему домовладению новый уровень комфорта энергоэффективности.

Превратите свой домашнюю обстановку пригодным для проживания и модным!

Подробнее на [url=https://stroystandart-kirov.ru/]http://www.stroystandart-kirov.ru/

[/url]

Не предоставляйте свой жилье на волю случайности. Доверьтесь нашей команде и создайте уют вместе с нами!

best online pharmacy india indian pharmacy – india pharmacy indiapharmacy.guru

canadian pharmacy india indian pharmacy – п»їlegitimate online pharmacies india indiapharmacy.guru

Prostadine™ is a revolutionary new prostate support supplement designed to protect, restore, and enhance male prostate health.

https://canadapharmacy.guru/# canadian pharmacy drugs online canadapharmacy.guru

Aizen Power is a dietary supplement for male enhancement

canadian pharmacy meds [url=https://canadiandrugs.tech/#]best mail order pharmacy canada[/url] canadian pharmacy meds canadiandrugs.tech

Neotonics is a dietary supplement that offers help in retaining glowing skin and maintaining gut health for its users. It is made of the most natural elements that mother nature can offer and also includes 500 million units of beneficial microbiome.

https://indiapharmacy.guru/# india pharmacy indiapharmacy.guru

EndoPeak is a male health supplement with a wide range of natural ingredients that improve blood circulation and vitality.

Glucotrust is one of the best supplements for managing blood sugar levels or managing healthy sugar metabolism.

EyeFortin is a natural vision support formula crafted with a blend of plant-based compounds and essential minerals. It aims to enhance vision clarity, focus, and moisture balance.

https://indiapharmacy.guru/# online pharmacy india indiapharmacy.guru

Support the health of your ears with 100% natural ingredients, finally being able to enjoy your favorite songs and movies

GlucoBerry is a meticulously crafted supplement designed by doctors to support healthy blood sugar levels by harnessing the power of delphinidin—an essential compound.

new ed pills erectile dysfunction pills – buying ed pills online edpills.tech

http://edpills.tech/# gnc ed pills edpills.tech

canadian drug stores canadian pharmacy com – canadian pharmacy ed medications canadiandrugs.tech

https://canadiandrugs.tech/# buy canadian drugs canadiandrugs.tech

http://canadiandrugs.tech/# canadian pharmacy online ship to usa canadiandrugs.tech

online pharmacy india [url=https://indiapharmacy.guru/#]indian pharmacy paypal[/url] Online medicine order indiapharmacy.guru

https://gabapentin.life/# neurontin 100mg discount

how can i get generic clomid without insurance [url=http://clomid.club/#]cost of clomid pill[/url] get generic clomid pills

http://canadiandrugs.tech/# online canadian pharmacy canadiandrugs.tech

SonoVive™ is a completely natural hearing support formula made with powerful ingredients that help heal tinnitus problems and restore your hearing

https://canadiandrugs.tech/# canadian online pharmacy canadiandrugs.tech

BioFit™ is a Nutritional Supplement That Uses Probiotics To Help You Lose Weight

http://edpills.tech/# pills erectile dysfunction edpills.tech

Dentitox Pro is a liquid dietary solution created as a serum to support healthy gums and teeth. Dentitox Pro formula is made in the best natural way with unique, powerful botanical ingredients that can support healthy teeth.

The ingredients of Endo Pump Male Enhancement are all-natural and safe to use.

india pharmacy mail order pharmacy india – buy medicines online in india indiapharmacy.guru