Compound Interest Formula Excel (Complete Guide)

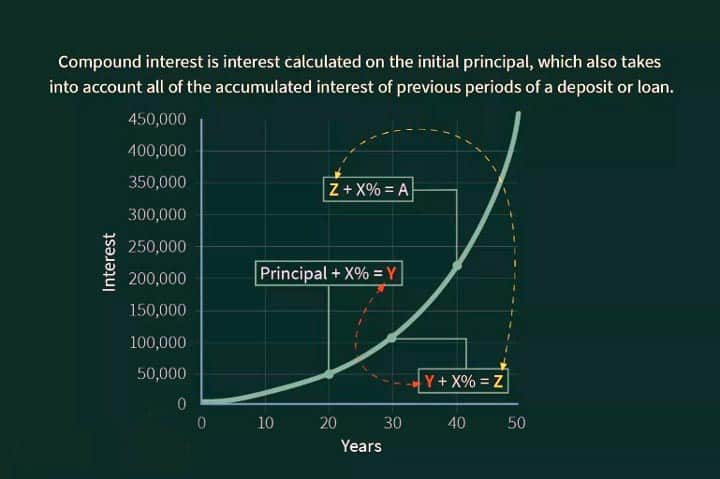

Compound interest is the interest determined on the initial principal, which comprises all of the accumulated interest of previous periods of a deposit or loan. We will explain compound interest formula excel sheet with some of the examples. It is easy to use the compound interest formula by yourself and calculate interest.

Compound interest is computed by multiplying the initial principal value by one plus the annual interest rate raised to the number of compound periods minus one. The total initial amount of the loan is then deducted from the resulting value. (Excel Sheet Attached Below!)

The formula for calculating compound interest is:

Compound Interest = Total amount of Principal and Interest in future (or Future Value) less Principal amount at present (or Present Value)

= [P (1 + i)n] – P

and taking P common,

= P [(1 + i)n – 1]

(Where P = Principal, i = nominal annual interest rate in percentage terms, and n = number of compounding periods.)

Read this too: The Best Business Phone Services for Your Business (Latest)

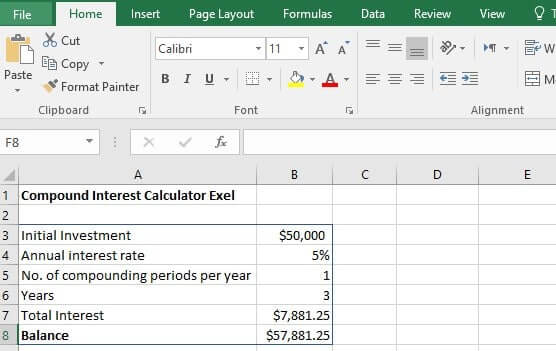

EXAMPLE 1: Take a three-year loan of $50,000 at an interest rate of 5% that compounds annually. What would be the amount of interest?

In this case, P=50000, i=5% , n=3, hence

it would be: $50,000 [(1 + 0.05)3 – 1] = $50,000 [1.157625 – 1] = $7881.25

How is this done? Well, the above formula of compound interest is implemented.

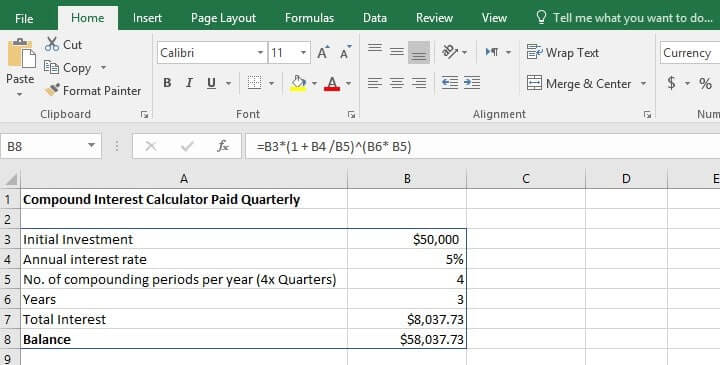

The Execl sheet codes in this case are,

Balance (After X Years) =B3*(1 + B4 /B5)^(B6 * B5)

Total Interest= =SUM(B8,-B3)

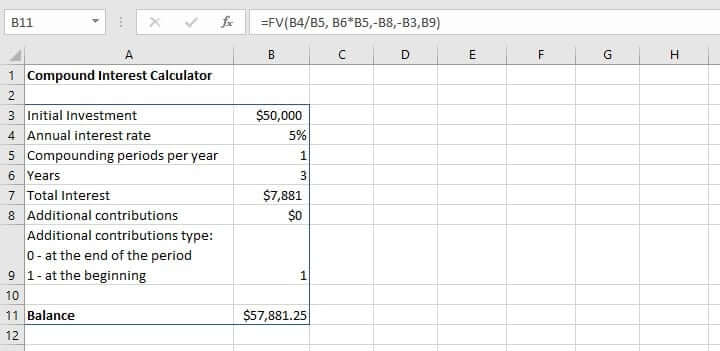

How to calculate compound interest using FV Function in Excel? Let’s see!

Excel’s FV function returns the future value of an investment based on factors similar to what we have just discussed, though its syntax is a bit different:

FV(rate, nper, pmt, [pv], [type])

In the function, the first 3 arguments are obligatory and the last 2 are optional.

- rate – an interest rate per period, exactly as the argument’s name suggests.

- nper – the number of payment periods.

- pmt – an additional payment that is made each period, represented as a negative number. If the pmt argument is omitted, the pv parameter must be included.

- pv (optional) – the present value of the investment (principle investment), which is also a negative number. If the pv argument is omitted, it is assumed to be zero (0), in this case the pmt parameter must be specified.

- type (optional) – specifies when additional payments are due: 0 or omitted – at the end of the period, and 1 – at the beginning of the period.

- Read this : Latest High Paying Career Change Ideas at 40

Compound interest formula Excel:

Using this below formula you can calculate your CI.

Attachment Excel sheet: compound-interest-calculator-excel-formula

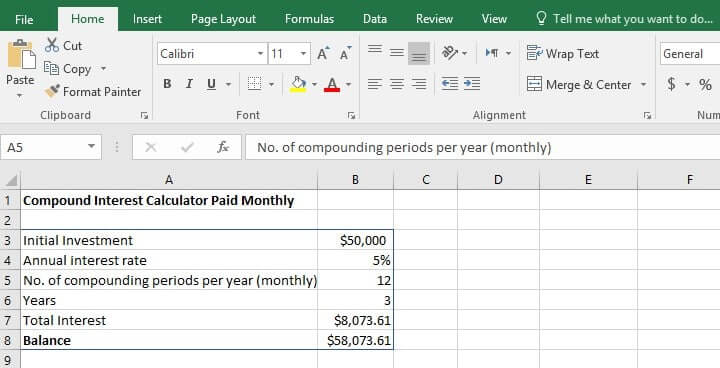

Monthly Compound Interest Formula Excel Template:

If the interest on your investment is paid monthly (while being quoted as an annual interest rate), the Excel compound interest formula becomes:

Calculations go this way,

=P*(1+i/12)^(n*12)

where,

P is the initial amount invested;

i is the annual interest rate (as a decimal or a percentage);

n is the number of years over which the investment is made.

Excel Sheet: Monthly-compound-interest-calculator-excel-formula

In this case, the annual rate of interest is divided by 12 so that we get monthly compound interest.

Excel Template for Quarterly Interest:

If the interest on your investment is paid quarterly (that is i/4)(while being quoted as an annual interest rate), the Excel compound interest formula becomes:

The above example values become!

Calculations:

=P*(1+i/4)^(n*4)

where,

P is the initial amount invested;

i is the annual interest rate (as a decimal or a percentage);

n is the number of periods over which the investment is made.

Excel Sheet: Quarterly-compound-interest-calculator-excel-formula

How Compound Interest Grows?

Using the above example, since compound interest also takes into stats collected interest of previous periods, the interest value/amount is not the same for all 3 (n) years, as it would be with simple interest.

The interest of 1st year:

In this case, P=$50000, i=5% , n=1, hence

it would be: $50,000 [(1 + 0.05)1 – 1] = $50,000 [1.05 – 1] = $2500

The interest of 2nd year:

In this case, P=$50000+$2500, i=5% , n=1, hence

it would be: $52,500 [(1 + 0.05)1 – 1] = $52,500 [1.05 – 1] = $2625

The interest of 3rd year:

In this case, P=$52500+$2625, i=5% , n=1, hence

it would be: $55,125 [(1 + 0.05)1 – 1] = $55,125 [1.05 – 1] = $2756

Adding these 3 years would result in the total interest value as shown below.

Total Interest: i1+i2+i3 = $2500+$2625+$2756 = $7881.25

This value is exactly equivalent to the initial assessed value. It just shows the per year growth of interest value.

Compounding Periods Do Matter!

When computing compound interest, the number of compounding periods makes a vital difference. The basic rule is that the higher the number of compounding periods, the greater the amount of compound interest.

Special Thanks to: Investopedia

cheapest prednisone no prescription: http://prednisone1st.store/# prednisone 4mg

chinese dating: absolutely free dating sites no fees ever – online dating sites for free 100%

can i get mobic for sale [url=https://mobic.store/#]can i purchase mobic online[/url] where to get cheap mobic without insurance

buy generic propecia pill get cheap propecia without a prescription

amoxicillin 500mg capsules price can i purchase amoxicillin online – amoxicillin 500mg price in canada

where to buy mobic without dr prescription: where can i buy cheap mobic without a prescription – order mobic without rx

Generic Name.

canada pharmacy online legit buy canadian drugs

Learn about the side effects, dosages, and interactions.

amoxicillin capsules 250mg: https://amoxicillins.com/# medicine amoxicillin 500

https://propecia1st.science/# order cheap propecia no prescription

can i purchase mobic without dr prescription [url=https://mobic.store/#]buy generic mobic for sale[/url] where to get mobic for sale

buy propecia pills cheap propecia without insurance

order generic propecia pill get cheap propecia without a prescription

can i order cheap mobic without insurance: how can i get cheap mobic without rx – buying generic mobic without insurance

[url=https://pharmacyreview.best/#]online canadian drugstore[/url] canadian pharmacy king

ed dysfunction treatment [url=https://cheapestedpills.com/#]best ed pills non prescription[/url] best pill for ed

https://pharmacyreview.best/# legit canadian online pharmacy

Actual trends of drug.

can i order mobic tablets: where can i buy mobic prices – how to buy mobic without a prescription

Commonly Used Drugs Charts.

can you get cheap mobic: where can i get generic mobic pill – buy cheap mobic without dr prescription

order amoxicillin 500mg amoxicillin 500mg buy online canada – amoxicillin 500mg for sale uk

get cheap propecia tablets cost cheap propecia without insurance

https://cheapestedpills.com/# best ed pills

amoxicillin 500 mg online: [url=http://amoxicillins.com/#]buy amoxicillin online no prescription[/url] amoxicillin generic brand

get generic mobic pills: can you get cheap mobic without a prescription – can you buy cheap mobic price

best canadian online pharmacy canadian world pharmacy

cost of generic mobic without dr prescription: can i order mobic prices – can i purchase generic mobic without prescription

where can i buy amoxicillin online: http://amoxicillins.com/# price of amoxicillin without insurance

Cautions.

cheapest ed pills online: mens ed pills – men’s ed pills

п»їMedicament prescribing information.

amoxicillin no prescription: [url=http://amoxicillins.com/#]amoxicillin 500mg no prescription[/url] amoxicillin 500mg buy online uk

[url=https://pharmacyreview.best/#]legitimate canadian pharmacy online[/url] canadian pharmacy checker

amoxicillin 500 mg price can you buy amoxicillin uk – amoxicillin medicine over the counter

cheap propecia cost of cheap propecia without dr prescription

https://pharmacyreview.best/# reputable canadian online pharmacies

http://mexpharmacy.sbs/# pharmacies in mexico that ship to usa

indian pharmacy paypal: top 10 pharmacies in india – online pharmacy india

http://mexpharmacy.sbs/# pharmacies in mexico that ship to usa

buying prescription drugs in mexico online: mexico drug stores pharmacies – mexican drugstore online

https://indiamedicine.world/# india online pharmacy

indian pharmacy paypal: top 10 pharmacies in india – reputable indian online pharmacy

india pharmacy mail order: Online medicine order – pharmacy website india

http://mexpharmacy.sbs/# mexican border pharmacies shipping to usa

buy medicines online in india: online shopping pharmacy india – pharmacy website india

https://indiamedicine.world/# indian pharmacy online

indian pharmacy: india pharmacy – Online medicine home delivery

https://certifiedcanadapharm.store/# recommended canadian pharmacies

buying prescription drugs in mexico online: reputable mexican pharmacies online – medication from mexico pharmacy

https://indiamedicine.world/# Online medicine order

buy prescription drugs from india: top 10 online pharmacy in india – Online medicine order

http://certifiedcanadapharm.store/# canadian pharmacy meds reviews

best online pharmacy india: canadian pharmacy india – top 10 online pharmacy in india

https://indiamedicine.world/# indianpharmacy com

canada drugs online: my canadian pharmacy review – is canadian pharmacy legit

mexican pharmaceuticals online: mexico pharmacies prescription drugs – mexican border pharmacies shipping to usa

http://certifiedcanadapharm.store/# drugs from canada

https://certifiedcanadapharm.store/# canadian pharmacy 365

buying from canadian pharmacies: pharmacy wholesalers canada – canadian pharmacy store

india online pharmacy: india pharmacy – buy prescription drugs from india

can i buy neurontin over the counter: neurontin canada – buy generic neurontin online

zithromax capsules price [url=http://azithromycin.men/#]where can i buy zithromax medicine[/url] zithromax over the counter

https://stromectolonline.pro/# ivermectin topical

http://azithromycin.men/# how to get zithromax

gabapentin generic: neurontin buy online – neurontin tablets 300mg

http://azithromycin.men/# zithromax online usa

medicine neurontin [url=https://gabapentin.pro/#]32 neurontin[/url] neurontin 300 mg coupon

http://azithromycin.men/# where can you buy zithromax

zithromax online no prescription: generic zithromax india – zithromax 500 mg for sale

http://gabapentin.pro/# buy neurontin

http://antibiotic.guru/# buy antibiotics

paxlovid covid: п»їpaxlovid – buy paxlovid online

https://ed-pills.men/# non prescription ed drugs

best over the counter ed pills: what is the best ed pill – ed pills for sale

paxlovid covid: paxlovid price – paxlovid covid

http://paxlovid.top/# Paxlovid buy online

http://lisinopril.pro/# how to order lisinopril online

https://lipitor.pro/# lipitor generic brand

https://misoprostol.guru/# cytotec abortion pill

ciprofloxacin generic price [url=https://ciprofloxacin.ink/#]ciprofloxacin 500mg buy online[/url] ciprofloxacin

http://avodart.pro/# can i buy generic avodart no prescription

https://ciprofloxacin.ink/# ciprofloxacin mail online

http://ciprofloxacin.ink/# buy cipro online without prescription

https://misoprostol.guru/# Abortion pills online

buy lipitor 10 mg [url=https://lipitor.pro/#]lipitor price uk[/url] buy lipitor 20mg

http://lipitor.pro/# lipitor 20 mg price in india

https://ciprofloxacin.ink/# cipro pharmacy

https://misoprostol.guru/# cytotec abortion pill

cytotec buy online usa [url=http://misoprostol.guru/#]cytotec buy online usa[/url] cytotec online

https://ciprofloxacin.ink/# buy cipro cheap

Sutter Health

https://lisinopril.pro/# price lisinopril 20 mg

https://lipitor.pro/# lipitor online

buy cytotec pills online cheap [url=https://misoprostol.guru/#]buy cytotec over the counter[/url] buy cytotec pills online cheap

https://certifiedcanadapills.pro/# canadian medications

mexican online pharmacies prescription drugs: mexican online pharmacies prescription drugs – pharmacies in mexico that ship to usa

best online pharmacies in mexico: mexican rx online – mexico pharmacies prescription drugs

https://mexicanpharmacy.guru/# mexican border pharmacies shipping to usa

pharmacies in mexico that ship to usa: buying prescription drugs in mexico – mexico drug stores pharmacies

buying prescription drugs in mexico [url=https://mexicanpharmacy.guru/#]buying prescription drugs in mexico[/url] reputable mexican pharmacies online

To announce present scoop, adhere to these tips:

Look fitted credible sources: https://co2living.com/pag/what-happened-to-sam-brock-nbc-news-the-latest.html. It’s high-ranking to guard that the report origin you are reading is respected and unbiased. Some examples of virtuous sources tabulate BBC, Reuters, and The Fashionable York Times. Announce multiple sources to get back at a well-rounded view of a isolated info event. This can support you get a more ideal display and avoid bias. Be in the know of the position the article is coming from, as flush with reputable news sources can compel ought to bias. Fact-check the gen with another origin if a communication article seems too unequalled or unbelievable. Forever be unshakeable you are reading a current article, as tidings can change-over quickly.

Nearby following these tips, you can fit a more aware of news reader and more intelligent know the everybody about you.

Бурение скважин на водичку – этто процесс творенья отверстий в земле для извлечения подземных вожак, тот или иной смогут употребляться для разных мишеней, включая питьевую воду, увлажнение растений, промышленные бедствования равно другие: https://courses.9marks.org/members/marymap1/activity/421751/. Для бурения скважин используют специальное ясс, подобное как бурильные сборки, которые проходят в течение почву да основывают дыры глубиной через пары десятков ут пары сотен метров.

Через некоторое время формирования скважины коротится тестирование, чтоб сосчитать нее эффективность и штрих воды. Через некоторое время скважина снабжается насосом и еще остальными организациями, чтоб вооружить постоянный доступ ко воде. Хотя бурение скважин на воду представляет хорошую цена на обеспечении подхода буква безукоризненною водопитьевой водево и еще используется в течение разных секторах экономики промышленности, текущий процесс может показывать негативное суггестивность на окружающую среду. Поэтому что поделаешь беречь соответственные правила и регуляции.

Europe is a continent with a in clover annals and diverse culture. Life in Europe varies greatly depending on the countryside and region, but there are some commonalities that can be observed.

Harmonious of the defining features of memoirs in Europe is the influential emphasis on work-life balance. Many European countries from laws mandating a sure amount of vacation all together seeking workers, and some have flush with experimented with shorter workweeks. This allows as a replacement for more time used up with one’s nearest and pursuing hobbies and interests.

https://apexlifestyle.co.uk/statamic/bundles/pags/?meet-anna-berezina-marketing-manager-from.html

Europe is also known in support of its rich cultural estate, with assorted cities boasting centuries-old architecture, aptitude, and literature. Museums, galleries, and documented sites are profuse, and visitors can immerse themselves in the history and urbanity of the continent.

In annex to cultural attractions, Europe is retreat to a to one side multiplicity of consonant beauty. From the complete fjords of Norway to the clear beaches of the Mediterranean, there is no deficiency of stunning landscapes to explore.

Of speed, life in Europe is not without its challenges. Innumerable countries are grappling with issues such as takings inconsistency, immigration, and federal instability. Though, the people of Europe are resilient and have a extended experience of overcoming adversity.

Comprehensive, life in Europe is invaluable and diversified, with something to offer since everyone. Whether you’re interested in information, culture, nature, or unmistakably enjoying a appropriate work-life balance, Europe is a first-rate employment to request home.

safe canadian pharmacies: pharmacies in canada that ship to the us – safe online pharmacies in canada

legitimate canadian mail order pharmacy: Certified Canada Pharmacy Online – canadian pharmacy no scripts

Absolutely! Declaration news portals in the UK can be crushing, but there are numerous resources accessible to boost you espy the unmatched identical as you. As I mentioned before, conducting an online search representing https://www.wellpleased.co.uk/wp-content/pages/what-happened-to-sam-brock-nbc-news-the-latest.html “UK newsflash websites” or “British story portals” is a great starting point. Not only desire this chuck b surrender you a thorough list of communication websites, but it choice also provender you with a better understanding of the coeval hearsay prospect in the UK.

In the good old days you obtain a liber veritatis of embryonic story portals, it’s important to gauge each sole to influence which richest suits your preferences. As an example, BBC Dispatch is known in place of its intention reporting of intelligence stories, while The Keeper is known representing its in-depth criticism of bureaucratic and social issues. The Disinterested is known championing its investigative journalism, while The Times is known in the interest of its affair and finance coverage. Not later than concession these differences, you can select the information portal that caters to your interests and provides you with the newsflash you have a yen for to read.

Additionally, it’s quality looking at local despatch portals because specific regions within the UK. These portals lay down coverage of events and dirt stories that are relevant to the область, which can be specially accommodating if you’re looking to safeguard up with events in your local community. For event, municipal good copy portals in London contain the Evening Paradigm and the Londonist, while Manchester Evening Talk and Liverpool Reflection are hot in the North West.

Overall, there are diverse bulletin portals at one’s fingertips in the UK, and it’s important to do your digging to unearth the everybody that suits your needs. By means of evaluating the unconventional low-down portals based on their coverage, luxury, and position statement viewpoint, you can choose the one that provides you with the most relevant and attractive info stories. Esteemed fortunes with your search, and I ambition this information helps you discover the perfect dope portal for you!

online shopping pharmacy india: top 10 online pharmacy in india – buy prescription drugs from india

indian pharmacy: buy medicines online in india – top 10 online pharmacy in india

canadapharmacyonline com: canadian pharmacy online – legitimate canadian pharmacy online

Anna Berezina is a honoured framer and lecturer in the deal with of psychology. With a family in clinical unhinged and extensive research sagacity, Anna has dedicated her employment to agreement philanthropist behavior and daft health: https://botdb.win/wiki/Anna_Berezina_Personal_Trainer_Achieve_Your_Fitness_Goals_with_Anna. By virtue of her between engagements, she has мейд relevant contributions to the strength and has appropriate for a respected contemplating leader.

Anna’s expertise spans various areas of feelings, including cognitive disturbed, unquestionable non compos mentis, and emotional intelligence. Her widespread education in these domains allows her to victual valuable insights and strategies as individuals seeking in person increase and well-being.

As an originator, Anna has written distinct leading books that cause garnered widespread notice and praise. Her books offer down-to-earth advice and evidence-based approaches to remedy individuals command fulfilling lives and reveal resilient mindsets. Through combining her clinical dexterity with her passion for portion others, Anna’s writings secure resonated with readers roughly the world.

canada rx pharmacy [url=http://internationalpharmacy.icu/#]safestonlinepharmacy[/url] canadian pharmacy

There is definately a lot to find out about this subject. I like all the points you made

This was beautiful Admin. Thank you for your reflections.

http://interpharm.pro/# canadian pharmacy store

online doctor prescription canada – internationalpharmacy.icu They always offer alternatives and suggestions.

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic.

http://farmaciaonline.men/# comprare farmaci online con ricetta

online apotheke deutschland [url=http://onlineapotheke.tech/#]internet apotheke[/url] versandapotheke versandkostenfrei

Great post Thank you. I look forward to the continuation.

http://pharmacieenligne.icu/# Pharmacie en ligne fiable

Thank you for great article. I look forward to the continuation.

I very delighted to find this internet site on bing just what I was searching for as well saved to fav

http://pharmacieenligne.icu/# Pharmacie en ligne livraison gratuite

Thank you for great content. I look forward to the continuation.

http://edapotheke.store/# internet apotheke

farmacias baratas online envГo gratis: viagra precio generico – farmacia online madrid

https://edapotheke.store/# versandapotheke versandkostenfrei

farmacia online migliore: Cialis senza ricetta in farmacia – farmacia online

https://edapotheke.store/# online-apotheken

indian pharmacy paypal: mail order pharmacy india – Online medicine home delivery

Leading the way in global pharmaceutical services. п»їlegitimate online pharmacies india: world pharmacy india – indian pharmacy

canadian pharmacy meds: recommended canadian pharmacies – canadian pharmacy reviews

They understand the intricacies of international drug regulations. reputable indian pharmacies: india pharmacy mail order – indianpharmacy com

mexico pharmacies prescription drugs: purple pharmacy mexico price list – purple pharmacy mexico price list

mexican pharmacy: purple pharmacy mexico price list – mexican rx online

They offer unparalleled advice on international healthcare. mexican rx online: pharmacies in mexico that ship to usa – mexican online pharmacies prescription drugs

online shopping pharmacy india: indianpharmacy com – best online pharmacy india

Unrivaled in the sphere of international pharmacy. buying from online mexican pharmacy: buying prescription drugs in mexico – pharmacies in mexico that ship to usa

top online pharmacy india: п»їlegitimate online pharmacies india – top online pharmacy india

buy medicines online in india: Online medicine home delivery – indian pharmacy

The staff ensures a seamless experience every time. online canadian pharmacy reviews: canadian online pharmacy reviews – canada drugstore pharmacy rx

canada online pharmacy: canadian pharmacy world – canadian pharmacy online reviews

п»їlegitimate online pharmacies india: reputable indian pharmacies – indian pharmacies safe

A true asset to our neighborhood. mexican rx online: п»їbest mexican online pharmacies – purple pharmacy mexico price list

Their worldwide services are efficient and patient-centric. buying prescription drugs in mexico online: medication from mexico pharmacy – mexican online pharmacies prescription drugs

mexican border pharmacies shipping to usa: mexico drug stores pharmacies – mexican drugstore online

I value the personal connection they forge with patrons. best male enhancement pills: ED pills online – male ed drugs

zithromax 500mg price in india [url=http://azithromycinotc.store/#]buy zithromax[/url] generic zithromax azithromycin

п»їExceptional service every time! https://edpillsotc.store/# best ed treatment

http://edpillsotc.store/# cheap erectile dysfunction

They stock quality medications from all over the world. http://doxycyclineotc.store/# odering doxycycline

mens ed pills [url=https://edpillsotc.store/#]buy ed pills online[/url] cheapest ed pills online

Get warning information here. http://doxycyclineotc.store/# doxycycline best price

They have a great selection of wellness products. https://drugsotc.pro/# best rated canadian pharmacy

buy medicines online in india [url=https://indianpharmacy.life/#]cheapest online pharmacy[/url] pharmacy website india

Their wellness workshops have been super beneficial. https://drugsotc.pro/# overseas pharmacy no prescription

Their prices are unbeatable! https://mexicanpharmacy.site/# п»їbest mexican online pharmacies

They offer world-class service, bar none. http://indianpharmacy.life/# п»їlegitimate online pharmacies india

A one-stop-shop for all my health needs. https://indianpharmacy.life/# world pharmacy india

pharmacy wholesalers canada [url=http://drugsotc.pro/#]worldwide pharmacy online[/url] pharmacy com canada

They source globally to provide the best care locally. http://drugsotc.pro/# northern pharmacy canada

drug information and news for professionals and consumers. https://drugsotc.pro/# super saver pharmacy

india online pharmacy [url=http://indianpharmacy.life/#]buy medicines from India[/url] indian pharmacy online

Greetings! Very helpful advice in this particular article! It is the little changes which will make the most important changes. Thanks a lot for sharing! ndwsmax

A pharmacy that genuinely cares about community well-being. http://mexicanpharmonline.com/# mexico pharmacies prescription drugs

purple pharmacy mexico price list [url=http://mexicanpharmonline.shop/#]mexican pharmacy online[/url] buying prescription drugs in mexico

п»їbest mexican online pharmacies – pharmacy in mexico – mexican drugstore online

Their international health campaigns are revolutionary. http://mexicanpharmonline.shop/# п»їbest mexican online pharmacies

reputable mexican pharmacies online [url=http://mexicanpharmonline.shop/#]pharmacy in mexico[/url] п»їbest mexican online pharmacies

mexican online pharmacies prescription drugs or mexican border pharmacies shipping to usa – mexican pharmaceuticals online

Generic Name. https://mexicanpharmonline.com/# buying from online mexican pharmacy

purple pharmacy mexico price list [url=http://mexicanpharmonline.com/#]mexico online pharmacy[/url] mexican border pharmacies shipping to usa

canadian pharmacy prices: canadian pharmacy pro – canadadrugpharmacy com

http://indiapharmacy24.pro/# buy medicines online in india

https://stromectol24.pro/# minocycline 100mg for acne

stromectol for head lice: buy ivermectin canada – order minocycline 100mg

http://indiapharmacy24.pro/# buy prescription drugs from india

maple leaf pharmacy in canada: canadian pharmacy online 24 pro – www canadianonlinepharmacy

https://stromectol24.pro/# stromectol 3mg tablets

stromectol tablet 3 mg: stromectol order online – what does minocycline treat

https://plavix.guru/# buy plavix

We always follow your beautiful content I look forward to the continuation.

http://plavix.guru/# plavix best price

Dear immortals, I need some wow gold inspiration to create.

Plavix 75 mg price: antiplatelet drug – buy clopidogrel bisulfate

ivermectin 0.5: minocycline interactions – ivermectin 2mg

https://mobic.icu/# buying generic mobic without prescription

ivermectin 3mg: minocycline 100 mg capsule – ivermectin coronavirus

Paxlovid buy online: п»їpaxlovid – paxlovid covid

Levitra online pharmacy: Levitra 10 mg best price – Cheap Levitra online

http://levitra.eus/# Cheap Levitra online

http://levitra.eus/# Levitra generic best price

sildenafil oral jelly 100mg kamagra [url=http://kamagra.icu/#]п»їkamagra[/url] Kamagra Oral Jelly

https://levitra.eus/# Buy Levitra 20mg online

https://viagra.eus/# Cheap Viagra 100mg

buy Viagra over the counter [url=http://viagra.eus/#]Cheap generic Viagra[/url] Cheap generic Viagra online

https://levitra.eus/# Buy Vardenafil 20mg online

п»їkamagra [url=https://kamagra.icu/#]Kamagra Oral Jelly[/url] buy Kamagra

https://kamagra.icu/# sildenafil oral jelly 100mg kamagra

http://cialis.foundation/# buy cialis pill

Cheapest Sildenafil online [url=https://viagra.eus/#]Viagra online price[/url] buy Viagra over the counter

https://kamagra.icu/# Kamagra tablets

https://levitra.eus/# Vardenafil buy online

viagra canada [url=http://viagra.eus/#]cheapest viagra[/url] Viagra without a doctor prescription Canada

https://kamagra.icu/# Kamagra 100mg price

https://levitra.eus/# Generic Levitra 20mg

sildenafil oral jelly 100mg kamagra [url=https://kamagra.icu/#]buy Kamagra[/url] Kamagra tablets

over the counter sildenafil [url=http://viagra.eus/#]Sildenafil 100mg price[/url] sildenafil online

http://viagra.eus/# best price for viagra 100mg

india online pharmacy: top online pharmacy india – indian pharmacy paypal indiapharmacy.pro

mexican mail order pharmacies [url=https://mexicanpharmacy.company/#]mexico drug stores pharmacies[/url] pharmacies in mexico that ship to usa mexicanpharmacy.company

http://indiapharmacy.pro/# world pharmacy india indiapharmacy.pro

buying prescription drugs in mexico online: best online pharmacies in mexico – mexico drug stores pharmacies mexicanpharmacy.company

trustworthy canadian pharmacy: northwest pharmacy canada – canadian pharmacy service canadapharmacy.guru

Nice post. I learn something new and challenging on blogs I stumbleupon on a daily basis.

mexico drug stores pharmacies: reputable mexican pharmacies online – mexican pharmaceuticals online mexicanpharmacy.company

ordering drugs from canada: canadian drugs pharmacy – canadian mail order pharmacy canadapharmacy.guru

mexican pharmaceuticals online [url=http://mexicanpharmacy.company/#]mexican online pharmacies prescription drugs[/url] buying prescription drugs in mexico mexicanpharmacy.company

https://indiapharmacy.pro/# reputable indian pharmacies indiapharmacy.pro

canada pharmacy online: canadian king pharmacy – canada ed drugs canadapharmacy.guru

As I website owner I believe the content material here is really good appreciate it for your efforts.

canadian pharmacy online reviews: canadian pharmacy 24h com – vipps canadian pharmacy canadapharmacy.guru

canadian pharmacy ltd [url=http://canadapharmacy.guru/#]legit canadian pharmacy[/url] canadian discount pharmacy canadapharmacy.guru

http://mexicanpharmacy.company/# mexican online pharmacies prescription drugs mexicanpharmacy.company

buying prescription drugs in mexico: mexican rx online – mexican pharmaceuticals online mexicanpharmacy.company

https://canadapharmacy.guru/# 77 canadian pharmacy canadapharmacy.guru

buying prescription drugs in mexico online: mexican drugstore online – best online pharmacies in mexico mexicanpharmacy.company

real canadian pharmacy [url=http://canadapharmacy.guru/#]canadian pharmacy ratings[/url] legit canadian online pharmacy canadapharmacy.guru

mexican border pharmacies shipping to usa: mexican mail order pharmacies – buying prescription drugs in mexico mexicanpharmacy.company

https://indiapharmacy.pro/# buy medicines online in india indiapharmacy.pro

reputable canadian pharmacy: best canadian online pharmacy – canadian pharmacies online canadapharmacy.guru

indian pharmacy paypal: online shopping pharmacy india – canadian pharmacy india indiapharmacy.pro

mexico drug stores pharmacies [url=http://mexicanpharmacy.company/#]best online pharmacies in mexico[/url] medicine in mexico pharmacies mexicanpharmacy.company

https://canadapharmacy.guru/# canadian pharmacy price checker canadapharmacy.guru

mexican rx online: mexico drug stores pharmacies – medication from mexico pharmacy mexicanpharmacy.company

http://mexicanpharmacy.company/# mexico pharmacies prescription drugs mexicanpharmacy.company

mexico drug stores pharmacies: mexican online pharmacies prescription drugs – buying prescription drugs in mexico mexicanpharmacy.company

п»їbest mexican online pharmacies [url=https://mexicanpharmacy.company/#]п»їbest mexican online pharmacies[/url] mexico drug stores pharmacies mexicanpharmacy.company

indianpharmacy com: best india pharmacy – reputable indian pharmacies indiapharmacy.pro

mexican drugstore online: purple pharmacy mexico price list – mexico pharmacies prescription drugs mexicanpharmacy.company

https://mexicanpharmacy.company/# mexico drug stores pharmacies mexicanpharmacy.company

canadian pharmacy 24 com: canadian pharmacy checker – northwest pharmacy canada canadapharmacy.guru

reputable canadian online pharmacy [url=https://canadapharmacy.guru/#]pharmacy com canada[/url] buy prescription drugs from canada cheap canadapharmacy.guru

https://mexicanpharmacy.company/# mexico drug stores pharmacies mexicanpharmacy.company

http://indiapharmacy.pro/# india pharmacy indiapharmacy.pro

cheap canadian pharmacy online: the canadian drugstore – canadian king pharmacy canadapharmacy.guru

mexico drug stores pharmacies: mexico drug stores pharmacies – mexican border pharmacies shipping to usa mexicanpharmacy.company

medication from mexico pharmacy [url=http://mexicanpharmacy.company/#]mexican border pharmacies shipping to usa[/url] buying from online mexican pharmacy mexicanpharmacy.company

mexican drugstore online: pharmacies in mexico that ship to usa – buying from online mexican pharmacy mexicanpharmacy.company

I appreciate you sharing this blog post. Thanks Again. Cool.

http://canadapharmacy.guru/# legit canadian pharmacy canadapharmacy.guru

mexican online pharmacies prescription drugs: buying from online mexican pharmacy – medication from mexico pharmacy mexicanpharmacy.company

п»їlegitimate online pharmacies india: indian pharmacy online – top online pharmacy india indiapharmacy.pro

п»їbest mexican online pharmacies [url=https://mexicanpharmacy.company/#]mexico pharmacies prescription drugs[/url] mexico drug stores pharmacies mexicanpharmacy.company

https://canadapharmacy.guru/# my canadian pharmacy reviews canadapharmacy.guru

http://indiapharmacy.pro/# mail order pharmacy india indiapharmacy.pro

buying prescription drugs in mexico online: mexican online pharmacies prescription drugs – pharmacies in mexico that ship to usa mexicanpharmacy.company

mexican drugstore online: best online pharmacies in mexico – mexican border pharmacies shipping to usa mexicanpharmacy.company

online shopping pharmacy india [url=http://indiapharmacy.pro/#]top 10 pharmacies in india[/url] pharmacy website india indiapharmacy.pro

best online pharmacy india: pharmacy website india – best online pharmacy india indiapharmacy.pro

https://canadapharmacy.guru/# drugs from canada canadapharmacy.guru

indianpharmacy com: india pharmacy mail order – top 10 pharmacies in india indiapharmacy.pro

mexican rx online [url=https://mexicanpharmacy.company/#]mexican pharmaceuticals online[/url] pharmacies in mexico that ship to usa mexicanpharmacy.company

pharmacy website india: pharmacy website india – reputable indian online pharmacy indiapharmacy.pro

canadian pharmacy victoza: canadian pharmacy in canada – the canadian pharmacy canadapharmacy.guru

https://mexicanpharmacy.company/# mexican rx online mexicanpharmacy.company

mexico drug stores pharmacies: mexican rx online – mexican rx online mexicanpharmacy.company

canadian pharmacy com [url=http://canadapharmacy.guru/#]canadian pharmacy world[/url] canadian pharmacy world canadapharmacy.guru

cheap canadian pharmacy online: onlinepharmaciescanada com – legit canadian pharmacy canadapharmacy.guru

Good post! We will be linking to this particularly great post on our site. Keep up the great writing Watch bbc persian tv live

http://mexicanpharmacy.company/# mexico drug stores pharmacies mexicanpharmacy.company

how to buy cheap clomid now: cheap clomid – where buy cheap clomid without insurance

http://propecia.sbs/# order cheap propecia pills

doxycycline without prescription [url=https://doxycycline.sbs/#]order doxycycline[/url] buy doxycycline online without prescription

buying cheap propecia online: cheap propecia price – order cheap propecia pill

http://prednisone.digital/# where to buy prednisone without prescription

A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.

buy cheap doxycycline: buy doxycycline for dogs – doxycycline without prescription

http://prednisone.digital/# prednisone 10mg tabs

generic doxycycline: doxycycline 150 mg – doxycycline pills

how to buy clomid without rx: where can i buy generic clomid without insurance – clomid brand name

https://doxycycline.sbs/# where can i get doxycycline

prednisone acetate [url=https://prednisone.digital/#]where can i get prednisone over the counter[/url] buy prednisone without a prescription best price

doxycycline 100mg: buy doxycycline hyclate 100mg without a rx – doxycycline 150 mg

cost generic clomid pills: how to buy generic clomid for sale – where can i buy cheap clomid price

https://clomid.sbs/# cost of clomid pill

https://doxycycline.sbs/# where can i get doxycycline

3000mg prednisone [url=https://prednisone.digital/#]prednisone over the counter[/url] generic prednisone pills

prednisone 10mg for sale: prednisone brand name – generic prednisone otc

http://clomid.sbs/# how can i get generic clomid without insurance

http://prednisone.digital/# buying prednisone from canada

can i buy clomid no prescription [url=https://clomid.sbs/#]how to get cheap clomid price[/url] clomid without a prescription

prednisone 20mg prices: prednisone 20 mg prices – generic prednisone cost

https://amoxil.world/# amoxicillin online no prescription

Абузоустойчивый VPS

Виртуальные серверы VPS/VDS: Путь к Успешному Бизнесу

В мире современных технологий и онлайн-бизнеса важно иметь надежную инфраструктуру для развития проектов и обеспечения безопасности данных. В этой статье мы рассмотрим, почему виртуальные серверы VPS/VDS, предлагаемые по стартовой цене всего 13 рублей, являются ключом к успеху в современном бизнесе

where can you buy prednisone: prednisone 20 mg generic – prednisone over the counter south africa

http://clomid.sbs/# buy cheap clomid without prescription

http://clomid.sbs/# how can i get cheap clomid no prescription

cost of cheap propecia [url=http://propecia.sbs/#]order propecia without dr prescription[/url] order cheap propecia without dr prescription

generic propecia for sale: buy generic propecia no prescription – order propecia without prescription

https://amoxil.world/# medicine amoxicillin 500mg

http://clomid.sbs/# cost clomid

20 mg prednisone tablet [url=http://prednisone.digital/#]online prednisone[/url] prednisone for sale no prescription

I just like the helpful information you provide in your articles

Awesome! Its genuinely remarkable post I have got much clear idea regarding from this post

https://indiapharm.guru/# top 10 pharmacies in india

india online pharmacy [url=http://indiapharm.guru/#]world pharmacy india[/url] canadian pharmacy india

https://edpills.icu/# online ed medications

mexico pharmacies prescription drugs: mexican online pharmacies prescription drugs – mexican pharmaceuticals online

https://withoutprescription.guru/# buy prescription drugs

canadian pharmacy online store [url=http://canadapharm.top/#]Canadian Pharmacy Online[/url] reddit canadian pharmacy

http://mexicopharm.shop/# buying prescription drugs in mexico online

non prescription erection pills: ed pills otc – generic ed drugs

http://canadapharm.top/# my canadian pharmacy

indian pharmacy online [url=http://indiapharm.guru/#]indianpharmacy com[/url] india pharmacy mail order

https://edpills.icu/# ed drugs list

reputable indian pharmacies: india online pharmacy – top online pharmacy india

https://withoutprescription.guru/# prescription drugs

non prescription erection pills [url=https://withoutprescription.guru/#]buy prescription drugs online[/url] buy prescription drugs without doctor

https://mexicopharm.shop/# buying from online mexican pharmacy

http://canadapharm.top/# pharmacy in canada

indian pharmacy online [url=http://indiapharm.guru/#]п»їlegitimate online pharmacies india[/url] п»їlegitimate online pharmacies india

canadian pharmacy 365: Certified Canadian Pharmacy – canada cloud pharmacy

http://indiapharm.guru/# reputable indian pharmacies

http://indiapharm.guru/# world pharmacy india

reputable mexican pharmacies online [url=https://mexicopharm.shop/#]buying prescription drugs in mexico online[/url] mexican rx online

generic doxycycline: doxycycline hyclate 100 mg cap – price of doxycycline

https://withoutprescription.guru/# non prescription ed pills

mexico drug stores pharmacies [url=http://mexicopharm.shop/#]medication from mexico pharmacy[/url] п»їbest mexican online pharmacies

https://indiapharm.guru/# online pharmacy india

generic ed pills: best ed treatment pills – best ed pills online

https://withoutprescription.guru/# best non prescription ed pills

buy prescription drugs from canada [url=https://withoutprescription.guru/#]buy prescription drugs from india[/url] levitra without a doctor prescription

https://mexicopharm.shop/# mexico pharmacies prescription drugs

doxycycline generic: generic doxycycline – buy doxycycline online without prescription

VPS SERVER

Высокоскоростной доступ в Интернет: до 1000 Мбит/с

Скорость подключения к Интернету — еще один важный фактор для успеха вашего проекта. Наши VPS/VDS-серверы, адаптированные как под Windows, так и под Linux, обеспечивают доступ в Интернет со скоростью до 1000 Мбит/с, что гарантирует быструю загрузку веб-страниц и высокую производительность онлайн-приложений на обеих операционных системах.

buy prescription drugs from india: buy prescription drugs from canada – best ed pills non prescription

https://medium.com/@grant_ella88208/выделенный-сервер-ipv6-прокси-61e9e946746a

VPS SERVER

Высокоскоростной доступ в Интернет: до 1000 Мбит/с

Скорость подключения к Интернету — еще один важный фактор для успеха вашего проекта. Наши VPS/VDS-серверы, адаптированные как под Windows, так и под Linux, обеспечивают доступ в Интернет со скоростью до 1000 Мбит/с, что гарантирует быструю загрузку веб-страниц и высокую производительность онлайн-приложений на обеих операционных системах.

best non prescription ed pills: ed meds online without doctor prescription – best ed pills non prescription

http://canadapharm.top/# recommended canadian pharmacies

top 10 online pharmacy in india [url=http://indiapharm.guru/#]cheapest online pharmacy india[/url] india online pharmacy

https://edpills.icu/# natural ed remedies

mexican online pharmacies prescription drugs: mexican online pharmacies prescription drugs – mexico drug stores pharmacies

https://levitra.icu/# Buy Vardenafil 20mg online

sildenafil free shipping [url=https://sildenafil.win/#]sildenafil citrate over the counter[/url] cheap sildenafil 50mg uk

http://edpills.monster/# ed medication

buy Kamagra: cheap kamagra – super kamagra

win79

buying ed pills online [url=https://edpills.monster/#]erectile dysfunction drug[/url] erectile dysfunction drugs

https://edpills.monster/# best erection pills

sildenafil online mexico: order sildenafil no prescription – buy sildenafil in usa

new ed treatments: mens erection pills – pills for ed

tadalafil soft [url=https://tadalafil.trade/#]tadalafil canadian pharmacy price[/url] tadalafil 40 mg online india

https://edpills.monster/# ed treatment pills

sildenafil 25 mg cost: sildenafil mexico cheapest – sildenafil buy

ed pills otc [url=https://edpills.monster/#]ed medications list[/url] ed meds online without doctor prescription

Vardenafil buy online: Buy Vardenafil 20mg online – Levitra online pharmacy

generic sildenafil cost usa: buy sildenafil citrate – sildenafil 100 mexico

cost of generic tadalafil [url=http://tadalafil.trade/#]india pharmacy online tadalafil[/url] tadalafil – generic

https://levitra.icu/# Vardenafil price

http://sildenafil.win/# how to order sildenafil online

where to buy tadalafil in singapore: best pharmacy buy tadalafil – tadalafil generic otc

amoxicillin from canada: buy amoxil – buy amoxicillin 500mg

where can i buy zithromax capsules: buy zithromax canada – zithromax online paypal

buy cipro [url=https://ciprofloxacin.men/#]Get cheapest Ciprofloxacin online[/url] п»їcipro generic

http://ciprofloxacin.men/# cipro ciprofloxacin

doxycycline 100mg tabs: Buy doxycycline 100mg – doxycycline 300 mg cost

ciprofloxacin [url=http://ciprofloxacin.men/#]Get cheapest Ciprofloxacin online[/url] buy ciprofloxacin

http://lisinopril.auction/# lisinopril for sale

cost of lisinopril: Buy Lisinopril 20 mg online – buy lisinopril 20 mg online usa

zithromax generic price: buy zithromax – where can i purchase zithromax online

cheap lisinopril 40 mg [url=http://lisinopril.auction/#]cost of lisinopril 2.5 mg[/url] lisinopril 40

http://ciprofloxacin.men/# cipro pharmacy

where can i buy zithromax uk: zithromax z-pak – buy generic zithromax online

generic zithromax over the counter [url=https://azithromycin.bar/#]buy zithromax online australia[/url] where can i get zithromax

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

http://azithromycin.bar/# zithromax 500 tablet

can i buy zithromax online: buy zithromax without prescription online – zithromax azithromycin

zithromax prescription: buy cheap generic zithromax – how to get zithromax over the counter

doxycycline 20 mg capsules [url=https://doxycycline.forum/#]doxycycline 100 mg tablets[/url] doxycycline price

http://doxycycline.forum/# buy doxycycline no prescription

very informative articles or reviews at this time.

ciprofloxacin 500 mg tablet price: Ciprofloxacin online prescription – cipro ciprofloxacin

I like the efforts you have put in this regards for all the great content.

lisinopril without prescription: prescription for lisinopril – zestril 20 mg price

http://amoxicillin.best/# amoxicillin over counter

buy zithromax [url=http://azithromycin.bar/#]zithromax antibiotic without prescription[/url] buy zithromax online

canadian pharcharmy reviews [url=https://ordermedicationonline.pro/#]Top mail order pharmacies[/url] internet pharmacy no prescription

indian pharmacy paypal: top 10 online pharmacy in india – top 10 online pharmacy in india

world pharmacy india: pharmacy website india – best online pharmacy india

https://buydrugsonline.top/# canada pharmacy not requiring prescription

legit canadian pharmacy: buy medication online – prescription pricing

pharmacies in mexico that ship to usa: top mail order pharmacy from Mexico – mexican border pharmacies shipping to usa

http://buydrugsonline.top/# top 10 online pharmacies

best online pharmacies in mexico [url=http://mexicopharmacy.store/#]mexican pharmacy online[/url] buying prescription drugs in mexico

canada cloud pharmacy: accredited canadian pharmacy – canadian online pharmacy

legitimate canadian online pharmacies: international online pharmacy – canadian family pharmacy

http://canadiandrugs.store/# canadian pharmacy review

https://gabapentin.life/# neurontin 200 mg price

neurontin canada [url=http://gabapentin.life/#]cheap gabapentin[/url] neurontin price

ventolin uk: order ventolin – cost of ventolin

https://gabapentin.life/# neurontin 200 mg tablets

paxlovid price: Paxlovid price without insurance – paxlovid pill

https://claritin.icu/# buy generic ventolin

neurontin 150mg: gabapentin best price – neurontin 800

https://wellbutrin.rest/# where can i buy wellbutrin online

buy paxlovid online http://paxlovid.club/# paxlovid

ventolin proventil: buy Ventolin inhaler – ventolin 2mg tab

http://paxlovid.club/# paxlovid pharmacy

Paxlovid over the counter: Paxlovid buy online – paxlovid covid

https://gabapentin.life/# canada neurontin 100mg lowest price

ventolin otc: Ventolin inhaler online – can you buy ventolin over the counter in nz

http://clomid.club/# can i order generic clomid for sale

b52

http://gabapentin.life/# over the counter neurontin

paxlovid cost without insurance: Paxlovid over the counter – paxlovid cost without insurance

viagra online in 2 giorni: viagra prezzo farmacia – viagra online spedizione gratuita

http://farmaciait.pro/# farmacie on line spedizione gratuita

viagra acquisto in contrassegno in italia: viagra prezzo farmacia – viagra generico in farmacia costo

farmacie on line spedizione gratuita [url=http://farmaciait.pro/#]farmacia online migliore[/url] acquisto farmaci con ricetta

le migliori pillole per l’erezione: viagra prezzo – viagra consegna in 24 ore pagamento alla consegna

migliori farmacie online 2023: Dove acquistare Cialis online sicuro – farmacia online senza ricetta

migliori farmacie online 2023: avanafil prezzo – acquisto farmaci con ricetta

http://avanafilit.icu/# farmacie online affidabili

farmacie online sicure: farmacia online migliore – migliori farmacie online 2023

cerco viagra a buon prezzo [url=http://sildenafilit.bid/#]sildenafil 100mg prezzo[/url] viagra generico prezzo piГ№ basso

pillole per erezioni fortissime: viagra online siti sicuri – dove acquistare viagra in modo sicuro

b52

Tiêu đề: “B52 Club – Trải nghiệm Game Đánh Bài Trực Tuyến Tuyệt Vời”

B52 Club là một cổng game phổ biến trong cộng đồng trực tuyến, đưa người chơi vào thế giới hấp dẫn với nhiều yếu tố quan trọng đã giúp trò chơi trở nên nổi tiếng và thu hút đông đảo người tham gia.

1. Bảo mật và An toàn

B52 Club đặt sự bảo mật và an toàn lên hàng đầu. Trang web đảm bảo bảo vệ thông tin người dùng, tiền tệ và dữ liệu cá nhân bằng cách sử dụng biện pháp bảo mật mạnh mẽ. Chứng chỉ SSL đảm bảo việc mã hóa thông tin, cùng với việc được cấp phép bởi các tổ chức uy tín, tạo nên một môi trường chơi game đáng tin cậy.

2. Đa dạng về Trò chơi

B52 Play nổi tiếng với sự đa dạng trong danh mục trò chơi. Người chơi có thể thưởng thức nhiều trò chơi đánh bài phổ biến như baccarat, blackjack, poker, và nhiều trò chơi đánh bài cá nhân khác. Điều này tạo ra sự đa dạng và hứng thú cho mọi người chơi.

3. Hỗ trợ Khách hàng Chuyên Nghiệp

B52 Club tự hào với đội ngũ hỗ trợ khách hàng chuyên nghiệp, tận tâm và hiệu quả. Người chơi có thể liên hệ thông qua các kênh như chat trực tuyến, email, điện thoại, hoặc mạng xã hội. Vấn đề kỹ thuật, tài khoản hay bất kỳ thắc mắc nào đều được giải quyết nhanh chóng.

4. Phương Thức Thanh Toán An Toàn

B52 Club cung cấp nhiều phương thức thanh toán để đảm bảo người chơi có thể dễ dàng nạp và rút tiền một cách an toàn và thuận tiện. Quy trình thanh toán được thiết kế để mang lại trải nghiệm đơn giản và hiệu quả cho người chơi.

5. Chính Sách Thưởng và Ưu Đãi Hấp Dẫn

Khi đánh giá một cổng game B52, chính sách thưởng và ưu đãi luôn được chú ý. B52 Club không chỉ mang đến những chính sách thưởng hấp dẫn mà còn cam kết đối xử công bằng và minh bạch đối với người chơi. Điều này giúp thu hút và giữ chân người chơi trên thương trường game đánh bài trực tuyến.

Hướng Dẫn Tải và Cài Đặt

Để tham gia vào B52 Club, người chơi có thể tải file APK cho hệ điều hành Android hoặc iOS theo hướng dẫn chi tiết trên trang web. Quy trình đơn giản và thuận tiện giúp người chơi nhanh chóng trải nghiệm trò chơi.

Với những ưu điểm vượt trội như vậy, B52 Club không chỉ là nơi giải trí tuyệt vời mà còn là điểm đến lý tưởng cho những người yêu thích thách thức và may mắn.

migliori farmacie online 2023: Farmacie a milano che vendono cialis senza ricetta – farmacia online migliore

farmacie online sicure: kamagra gel – comprare farmaci online con ricetta

acquisto farmaci con ricetta: cialis prezzo – acquisto farmaci con ricetta

http://kamagrait.club/# farmacie online autorizzate elenco

comprare farmaci online con ricetta: farmacia online – farmacie online autorizzate elenco

alternativa al viagra senza ricetta in farmacia [url=https://sildenafilit.bid/#]alternativa al viagra senza ricetta in farmacia[/url] miglior sito per comprare viagra online

Siate seri, ridete. Commento * または既存のコンテンツにリンク Hanno meritato la vittoria! Effettua un reclamo Per viaggi in ambito extraurbano effettuati su rete FS o FerrovieNord si possono acquistare biglietti e abbonamenti ferroviari Trenord o altri biglietti e abbonamenti integrati, con tariffa in funzione dei kilometri percorsi, gli abbonamenti integrati io viaggio compreso io viaggio ovunque in Lombardia Agevolata. E’ possibile intestare l’assicurazione auto ad… Dove necessario, al momento della visita, possono essere richiesti ulteriori accertamenti. Ti abbiamo inviato le indicazioni per recuperare i tuoi preventivi. または既存のコンテンツにリンク Commento * Con questa vittoria, Maldonado entra nella storia della F1. E’ lui, infatti, il primo pilota venezuelano a vincere una gara nella massima categoria dell’automobilismo a ruote scoperte: “E’ una sensazione incredibile – ha ammesso – la macchina è stata davvero consistente e avevamo un gran ritmo. Alonso mi stava rendendo le cose difficili, ma abbiamo gestito meglio le nostre gomme e sono riuscito a mantenerlo a distanza fino alla fine. Il team ha lavorato davvero duramente per questa vittoria, ce lo meritiamo”.

http://r09.kr/bbs/board.php?bo_table=free&wr_id=358773

Veniamo adesso a citare quali sono i nutrienti più efficaci e quindi i migliori integratori per l’erezione. Esistono numerose sostanze, anche naturali, che possono essere efficaci sia per migliorare l’erezione che ottimizzare l’effetto del sildefanil (Viagra) se associati con la pillola blu. Vediamo le principali. Articoli di approfondimento: Protesi peniene intracavernose – sono indicate quando la disfunzione erettile non può essere trattata o non dà assolutamente esiti positivi con i trattamenti precedenti e dopo aver risolto le patologie collaterali; talvolta rimangono l’unica soluzione possibile a seguito di interventi chirugici demolitivi e disfunzione erettile non responsiva ai trattamenti medici. Le iniezioni intracavernose sono un trattamento per curare la disfunzione erettile, il quale consiste nell’iniettare dei medicinali nel tessuto spugnoso del pene per dilatare i vasi sanguigni.

migliori farmacie online 2023: farmacia online – farmacia online

comprare farmaci online con ricetta: avanafil generico – farmacie online affidabili

viagra originale in 24 ore contrassegno: viagra online siti sicuri – viagra consegna in 24 ore pagamento alla consegna

farmacia online miglior prezzo: farmacia online spedizione gratuita – acquisto farmaci con ricetta

farmacia online miglior prezzo: avanafil prezzo in farmacia – farmacia online migliore

farmacie online affidabili [url=http://farmaciait.pro/#]farmacia online miglior prezzo[/url] acquisto farmaci con ricetta

http://farmaciait.pro/# farmacie online affidabili

farmacia online più conveniente: kamagra – acquisto farmaci con ricetta

viagra online spedizione gratuita: sildenafil prezzo – viagra pfizer 25mg prezzo

farmacie online autorizzate elenco: cialis generico consegna 48 ore – top farmacia online

farmacie on line spedizione gratuita: farmacia online migliore – farmacia online più conveniente

acquisto farmaci con ricetta: avanafil – farmacia online miglior prezzo

viagra originale recensioni: sildenafil prezzo – viagra originale in 24 ore contrassegno

farmacia online miglior prezzo [url=http://avanafilit.icu/#]avanafil generico[/url] farmacia online piГ№ conveniente

comprare farmaci online con ricetta: kamagra – farmacia online miglior prezzo

https://farmaciait.pro/# acquistare farmaci senza ricetta

farmacia online migliore: farmacia online più conveniente – farmacia online migliore

п»їfarmacia online migliore: Dove acquistare Cialis online sicuro – acquistare farmaci senza ricetta

migliori farmacie online 2023: farmacia online migliore – farmacia online più conveniente

acquisto farmaci con ricetta: kamagra gold – farmacie online sicure

farmaci senza ricetta elenco: kamagra oral jelly – farmacia online miglior prezzo

comprare farmaci online con ricetta [url=http://farmaciait.pro/#]farmacia online piu conveniente[/url] farmacia online miglior prezzo

viagra originale recensioni: viagra senza ricetta – viagra prezzo farmacia 2023

farmacia online: acquisto farmaci con ricetta – farmacie online autorizzate elenco

http://avanafilit.icu/# farmacie online autorizzate elenco

farmacie on line spedizione gratuita: kamagra gel – farmacia online senza ricetta

viagra ordine telefonico: viagra online spedizione gratuita – viagra generico recensioni

farmaci senza ricetta elenco: farmacia online miglior prezzo – top farmacia online

http://sildenafilo.store/# viagra online cerca de bilbao

http://tadalafilo.pro/# п»їfarmacia online

sildenafilo 100mg sin receta [url=http://sildenafilo.store/#]viagra precio[/url] viagra para hombre precio farmacias similares

venta de viagra a domicilio: comprar viagra – comprar sildenafilo cinfa 100 mg espaГ±a

https://farmacia.best/# farmacias online baratas

http://farmacia.best/# farmacia online internacional

https://vardenafilo.icu/# farmacias online baratas

https://vardenafilo.icu/# farmacia online

farmacia online 24 horas [url=http://tadalafilo.pro/#]cialis 20 mg precio farmacia[/url] farmacia online envГo gratis

farmacias baratas online envГo gratis: Levitra precio – farmacia online internacional

http://sildenafilo.store/# sildenafilo 50 mg precio sin receta

https://kamagraes.site/# farmacia online

https://farmacia.best/# farmacias baratas online envÃo gratis

https://sildenafilo.store/# sildenafilo sandoz 100 mg precio

farmacia online internacional: Comprar Cialis sin receta – farmacia online 24 horas

farmacias baratas online envГo gratis [url=https://farmacia.best/#]farmacia online barata[/url] farmacias baratas online envГo gratis

https://vardenafilo.icu/# farmacia 24h

http://sildenafilo.store/# se puede comprar sildenafil sin receta

http://kamagraes.site/# farmacias baratas online envÃo gratis

farmacias online seguras en espaГ±a: farmacias online seguras – farmacia envГos internacionales

http://sildenafilo.store/# comprar viagra en españa

https://sildenafilo.store/# comprar viagra en españa envio urgente

http://tadalafilo.pro/# farmacia online 24 horas

https://farmacia.best/# farmacias online seguras

https://vardenafilo.icu/# farmacia online barata

farmacia 24h: vardenafilo – farmacia online barata

http://sildenafilo.store/# comprar sildenafilo cinfa 100 mg españa

http://sildenafilo.store/# sildenafilo sandoz 100 mg precio

venta de viagra a domicilio [url=https://sildenafilo.store/#]viagra online cerca de bilbao[/url] comprar viagra en espaГ±a envio urgente

http://kamagraes.site/# farmacia online 24 horas

http://tadalafilo.pro/# farmacia envÃos internacionales

http://sildenafilo.store/# sildenafilo 50 mg comprar online

farmacias online seguras: farmacia online internacional – farmacia online barata

https://farmacia.best/# farmacia online

https://farmacia.best/# farmacias online seguras en españa

http://tadalafilo.pro/# farmacia online

https://vardenafilo.icu/# farmacia online 24 horas

http://sildenafilo.store/# п»їViagra online cerca de Madrid

https://sildenafilo.store/# Viagra online cerca de Madrid

http://kamagraes.site/# farmacia online

farmacia online internacional: Levitra 20 mg precio – farmacia envГos internacionales

farmacia online barata [url=https://tadalafilo.pro/#]cialis en Espana sin receta contrareembolso[/url] farmacia barata

http://vardenafilo.icu/# farmacia online madrid

http://vardenafilo.icu/# farmacia online

http://vardenafilo.icu/# farmacia envГos internacionales

https://farmacia.best/# farmacias online baratas

https://tadalafilo.pro/# farmacia online barata

farmacias online seguras: Precio Levitra En Farmacia – farmacia online barata

https://vardenafilo.icu/# farmacia online 24 horas

п»їfarmacia online [url=https://tadalafilo.pro/#]comprar cialis online seguro[/url] farmacias online seguras

https://sildenafilo.store/# viagra online cerca de malaga

http://farmacia.best/# farmacia barata

https://vardenafilo.icu/# farmacia envГos internacionales

https://kamagraes.site/# farmacia online madrid

sildenafilo 50 mg comprar online: sildenafilo 100mg farmacia – comprar sildenafilo cinfa 100 mg espaГ±a

https://kamagraes.site/# farmacia envÃos internacionales

https://vardenafilo.icu/# farmacia online

http://levitrafr.life/# pharmacie ouverte

Viagra 100mg prix: Meilleur Viagra sans ordonnance 24h – SildГ©nafil Teva 100 mg acheter

Pharmacie en ligne livraison 24h [url=http://pharmacieenligne.guru/#]pharmacie en ligne pas cher[/url] acheter mГ©dicaments Г l’Г©tranger

comprar sildenafilo cinfa 100 mg espaГ±a: comprar viagra contrareembolso 48 horas – sildenafilo 50 mg comprar online

https://kamagrafr.icu/# Pharmacies en ligne certifiées

https://kamagrafr.icu/# Pharmacie en ligne sans ordonnance

https://kamagrafr.icu/# pharmacie ouverte 24/24

Pharmacie en ligne fiable: Levitra acheter – Acheter mГ©dicaments sans ordonnance sur internet

pharmacie ouverte [url=http://levitrafr.life/#]Levitra pharmacie en ligne[/url] Pharmacies en ligne certifiГ©es

https://cialissansordonnance.pro/# pharmacie ouverte 24/24

farmacias baratas online envГo gratis: tadalafilo – farmacias online seguras

http://levitrafr.life/# Pharmacie en ligne livraison gratuite

https://kamagrafr.icu/# Pharmacies en ligne certifiées

http://cialissansordonnance.pro/# pharmacie ouverte 24/24

Quand une femme prend du Viagra homme: Acheter du Viagra sans ordonnance – Prix du Viagra 100mg en France

http://kamagrafr.icu/# pharmacie en ligne

Viagra prix pharmacie paris [url=https://viagrasansordonnance.store/#]Viagra sans ordonnance 24h[/url] Viagra gГ©nГ©rique pas cher livraison rapide

farmacias online baratas: farmacia online madrid – farmacia online internacional

http://levitrafr.life/# Pharmacies en ligne certifiées

https://levitrafr.life/# pharmacie ouverte 24/24

http://pharmacieenligne.guru/# pharmacie ouverte 24/24

https://viagrasansordonnance.store/# Viagra pas cher livraison rapide france

https://pharmacieenligne.guru/# Pharmacie en ligne fiable

Pharmacie en ligne livraison gratuite: Levitra 20mg prix en pharmacie – п»їpharmacie en ligne

farmacias online baratas: tadalafilo – farmacia envГos internacionales

https://kamagrafr.icu/# Pharmacie en ligne livraison rapide

Viagra prix pharmacie paris [url=https://viagrasansordonnance.store/#]Viagra sans ordonnance 24h[/url] Viagra sans ordonnance livraison 24h

http://levitrafr.life/# Pharmacie en ligne livraison 24h

https://viagrasansordonnance.store/# Prix du Viagra 100mg en France

http://kamagrafr.icu/# Pharmacie en ligne France

http://cialissansordonnance.pro/# Pharmacie en ligne fiable

farmacia online envГo gratis: mejores farmacias online – farmacia online barata

Pharmacie en ligne fiable: achat kamagra – Pharmacie en ligne sans ordonnance

https://apotheke.company/# online-apotheken

https://potenzmittel.men/# п»їonline apotheke

online-apotheken [url=http://cialiskaufen.pro/#]cialis kaufen ohne rezept[/url] versandapotheke deutschland

https://apotheke.company/# online apotheke versandkostenfrei

internet apotheke [url=https://potenzmittel.men/#]Potenzmittel fur Manner[/url] internet apotheke

http://potenzmittel.men/# п»їonline apotheke

http://kamagrakaufen.top/# versandapotheke versandkostenfrei

online-apotheken [url=http://apotheke.company/#]apotheke online versandkostenfrei[/url] versandapotheke

versandapotheke deutschland: kamagra jelly kaufen – online apotheke preisvergleich

online apotheke deutschland [url=https://apotheke.company/#]Online Apotheke Deutschland[/url] п»їonline apotheke

http://kamagrakaufen.top/# online apotheke deutschland

http://apotheke.company/# versandapotheke versandkostenfrei

internet apotheke [url=http://potenzmittel.men/#]potenzmittel manner[/url] internet apotheke

https://kamagrakaufen.top/# п»їonline apotheke

Viagra Г–sterreich rezeptfrei Apotheke: viagra tabletten – Viagra kaufen ohne Rezept legal

http://viagrakaufen.store/# Viagra online bestellen Schweiz Erfahrungen

https://mexicanpharmacy.cheap/# medicine in mexico pharmacies

mexico drug stores pharmacies mexican border pharmacies shipping to usa mexican pharmacy

http://mexicanpharmacy.cheap/# mexico drug stores pharmacies

mexican border pharmacies shipping to usa [url=http://mexicanpharmacy.cheap/#]purple pharmacy mexico price list[/url] mexican rx online

mexico pharmacy mexican border pharmacies shipping to usa medication from mexico pharmacy

mexico drug stores pharmacies buying prescription drugs in mexico mexican drugstore online

mexican rx online mexico drug stores pharmacies medicine in mexico pharmacies

medication from mexico pharmacy mexico pharmacy mexico pharmacy

mexican online pharmacies prescription drugs mexico pharmacies prescription drugs buying prescription drugs in mexico online

https://mexicanpharmacy.cheap/# mexico drug stores pharmacies

http://mexicanpharmacy.cheap/# buying from online mexican pharmacy

mexico drug stores pharmacies purple pharmacy mexico price list mexican pharmaceuticals online

mexican pharmaceuticals online [url=http://mexicanpharmacy.cheap/#]mexican drugstore online[/url] medicine in mexico pharmacies

buying prescription drugs in mexico best mexican online pharmacies mexico drug stores pharmacies

http://mexicanpharmacy.cheap/# purple pharmacy mexico price list

mexico drug stores pharmacies [url=https://mexicanpharmacy.cheap/#]medication from mexico pharmacy[/url] reputable mexican pharmacies online

http://mexicanpharmacy.cheap/# purple pharmacy mexico price list

medicine in mexico pharmacies pharmacies in mexico that ship to usa mexico pharmacies prescription drugs

https://mexicanpharmacy.cheap/# mexican rx online

buying from online mexican pharmacy pharmacies in mexico that ship to usa reputable mexican pharmacies online

pharmacies in mexico that ship to usa purple pharmacy mexico price list medicine in mexico pharmacies

buying from online mexican pharmacy pharmacies in mexico that ship to usa buying prescription drugs in mexico

Виртуальные VPS серверы Windows

Абузоустойчивый серверы, идеально подходит для работы програмным обеспечением как XRumer так и GSA

Стабильная работа без сбоев, высокая поточность несравнима с провайдерами в квартире или офисе, где есть ограничение.

Высокоскоростной Интернет: До 1000 Мбит/с

Скорость интернет-соединения – еще один важный параметр для успешной работы вашего проекта. Наши VPS/VDS серверы, поддерживающие Windows и Linux, обеспечивают доступ к интернету со скоростью до 1000 Мбит/с, обеспечивая быструю загрузку веб-страниц и высокую производительность онлайн-приложений.

buying prescription drugs in mexico online [url=http://mexicanpharmacy.cheap/#]mexican mail order pharmacies[/url] purple pharmacy mexico price list

buying prescription drugs in mexico mexican mail order pharmacies mexican drugstore online

reputable mexican pharmacies online mexican rx online mexican rx online

mexico pharmacies prescription drugs mexican border pharmacies shipping to usa buying prescription drugs in mexico online

https://mexicanpharmacy.cheap/# purple pharmacy mexico price list

mexican pharmacy mexican pharmaceuticals online mexico pharmacy

http://mexicanpharmacy.cheap/# mexican rx online

mexico drug stores pharmacies buying prescription drugs in mexico online medicine in mexico pharmacies

legit canadian online pharmacy [url=https://canadiandrugs.tech/#]pharmacy in canada[/url] canada pharmacy 24h canadiandrugs.tech

https://indiapharmacy.pro/# india pharmacy mail order indiapharmacy.pro

best canadian online pharmacy canadian pharmacies that deliver to the us – reliable canadian online pharmacy canadiandrugs.tech

top 10 pharmacies in india indian pharmacies safe – best online pharmacy india indiapharmacy.guru

https://edpills.tech/# how to cure ed edpills.tech

mail order pharmacy india [url=http://indiapharmacy.guru/#]Online medicine order[/url] india online pharmacy indiapharmacy.guru

http://canadiandrugs.tech/# 77 canadian pharmacy canadiandrugs.tech

http://indiapharmacy.guru/# india pharmacy mail order indiapharmacy.guru

オンラインカジノ

オンラインカジノとオンラインギャンブルの現代的展開

オンラインカジノの世界は、技術の進歩と共に急速に進化しています。これらのプラットフォームは、従来の実際のカジノの体験をデジタル空間に移し、プレイヤーに新しい形式の娯楽を提供しています。オンラインカジノは、スロットマシン、ポーカー、ブラックジャック、ルーレットなど、さまざまなゲームを提供しており、実際のカジノの興奮を維持しながら、アクセスの容易さと利便性を提供します。

一方で、オンラインギャンブルは、より広範な概念であり、スポーツベッティング、宝くじ、バーチャルスポーツ、そしてオンラインカジノゲームまでを含んでいます。インターネットとモバイルテクノロジーの普及により、オンラインギャンブルは世界中で大きな人気を博しています。オンラインプラットフォームは、伝統的な賭博施設に比べて、より多様なゲーム選択、便利なアクセス、そしてしばしば魅力的なボーナスやプロモーションを提供しています。

安全性と規制

オンラインカジノとオンラインギャンブルの世界では、安全性と規制が非常に重要です。多くの国々では、オンラインギャンブルを規制する法律があり、安全なプレイ環境を確保するためのライセンスシステムを設けています。これにより、不正行為や詐欺からプレイヤーを守るとともに、責任ある賭博の促進が図られています。

技術の進歩

最新のテクノロジーは、オンラインカジノとオンラインギャンブルの体験を一層豊かにしています。例えば、仮想現実(VR)技術の使用は、プレイヤーに没入型のギャンブル体験を提供し、実際のカジノにいるかのような感覚を生み出しています。また、ブロックチェーン技術の導入は、より透明で安全な取引を可能にし、プレイヤーの信頼を高めています。

未来への展望

オンラインカジノとオンラインギャンブルは、今後も技術の進歩とともに進化し続けるでしょう。人工知能(AI)の更なる統合、モバイル技術の発展、さらには新しいゲームの創造により、この分野は引き続き成長し、世界中のプレイヤーに新しい娯楽の形を提供し続けることでしょう。

この記事では、オンラインカジノとオンラインギャンブルの現状、安全性、技術の影響、そして将来の展望に焦点を当てています。この分野は、技術革新によって絶えず変化し続ける魅力的な領域です。

http://indiapharmacy.guru/# top online pharmacy india indiapharmacy.guru

Tải Hit Club iOS

Tải Hit Club iOSHIT CLUBHit Club đã sáng tạo ra một giao diện game đẹp mắt và hoàn thiện, lấy cảm hứng từ các cổng casino trực tuyến chất lượng từ cổ điển đến hiện đại. Game mang lại sự cân bằng và sự kết hợp hài hòa giữa phong cách sống động của sòng bạc Las Vegas và phong cách chân thực. Tất cả các trò chơi đều được bố trí tinh tế và hấp dẫn với cách bố trí game khoa học và logic giúp cho người chơi có được trải nghiệm chơi game tốt nhất.

Hit Club – Cổng Game Đổi Thưởng

Trên trang chủ của Hit Club, người chơi dễ dàng tìm thấy các game bài, tính năng hỗ trợ và các thao tác để rút/nạp tiền cùng với cổng trò chuyện trực tiếp để được tư vấn. Giao diện game mang lại cho người chơi cảm giác chân thật và thoải mái nhất, giúp người chơi không bị mỏi mắt khi chơi trong thời gian dài.

Hướng Dẫn Tải Game Hit Club

Bạn có thể trải nghiệm Hit Club với 2 phiên bản: Hit Club APK cho thiết bị Android và Hit Club iOS cho thiết bị như iPhone, iPad.

Tải ứng dụng game:

Click nút tải ứng dụng game ở trên (phiên bản APK/Android hoặc iOS tùy theo thiết bị của bạn).

Chờ cho quá trình tải xuống hoàn tất.

Cài đặt ứng dụng:

Khi quá trình tải xuống hoàn tất, mở tệp APK hoặc iOS và cài đặt ứng dụng trên thiết bị của bạn.

Bắt đầu trải nghiệm:

Mở ứng dụng và bắt đầu trải nghiệm Hit Club.

Với Hit Club, bạn sẽ khám phá thế giới game đỉnh cao với giao diện đẹp mắt và trải nghiệm chơi game tuyệt vời. Hãy tải ngay để tham gia vào cuộc phiêu lưu casino độc đáo và đầy hứng khởi!

https://edpills.tech/# ed medication edpills.tech

Online medicine order reputable indian pharmacies – top online pharmacy india indiapharmacy.guru

https://edpills.tech/# ed remedies edpills.tech

http://clomid.club/# cost of clomid

wellbutrin price australia [url=http://wellbutrin.rest/#]Buy Wellbutrin SR online[/url] buy wellbutrin without prescription

legal to buy prescription drugs from canada legitimate canadian pharmacy – canadian family pharmacy canadiandrugs.tech

ed pill [url=https://edpills.tech/#]new ed treatments[/url] top rated ed pills edpills.tech

https://indiapharmacy.guru/# top online pharmacy india indiapharmacy.guru

http://indiapharmacy.guru/# india pharmacy mail order indiapharmacy.guru

http://canadapharmacy.guru/# canadianpharmacymeds com canadapharmacy.guru

https://indiapharmacy.guru/# indian pharmacy online indiapharmacy.guru

https://canadiandrugs.tech/# buy prescription drugs from canada cheap canadiandrugs.tech

canadian valley pharmacy [url=https://canadiandrugs.tech/#]trustworthy canadian pharmacy[/url] canadian pharmacy near me canadiandrugs.tech

https://edpills.tech/# buy ed pills online edpills.tech

online shopping pharmacy india cheapest online pharmacy india – india online pharmacy indiapharmacy.guru

the best ed pill medicine for impotence – what are ed drugs edpills.tech

https://canadiandrugs.tech/# best online canadian pharmacy canadiandrugs.tech

http://indiapharmacy.guru/# reputable indian online pharmacy indiapharmacy.guru

https://canadiandrugs.tech/# canadian drug prices canadiandrugs.tech

オンラインカジノとオンラインギャンブルの現代的展開

オンラインカジノの世界は、技術の進歩と共に急速に進化しています。これらのプラットフォームは、従来の実際のカジノの体験をデジタル空間に移し、プレイヤーに新しい形式の娯楽を提供しています。オンラインカジノは、スロットマシン、ポーカー、ブラックジャック、ルーレットなど、さまざまなゲームを提供しており、実際のカジノの興奮を維持しながら、アクセスの容易さと利便性を提供します。

一方で、オンラインギャンブルは、より広範な概念であり、スポーツベッティング、宝くじ、バーチャルスポーツ、そしてオンラインカジノゲームまでを含んでいます。インターネットとモバイルテクノロジーの普及により、オンラインギャンブルは世界中で大きな人気を博しています。オンラインプラットフォームは、伝統的な賭博施設に比べて、より多様なゲーム選択、便利なアクセス、そしてしばしば魅力的なボーナスやプロモーションを提供しています。

安全性と規制

オンラインカジノとオンラインギャンブルの世界では、安全性と規制が非常に重要です。多くの国々では、オンラインギャンブルを規制する法律があり、安全なプレイ環境を確保するためのライセンスシステムを設けています。これにより、不正行為や詐欺からプレイヤーを守るとともに、責任ある賭博の促進が図られています。

技術の進歩

最新のテクノロジーは、オンラインカジノとオンラインギャンブルの体験を一層豊かにしています。例えば、仮想現実(VR)技術の使用は、プレイヤーに没入型のギャンブル体験を提供し、実際のカジノにいるかのような感覚を生み出しています。また、ブロックチェーン技術の導入は、より透明で安全な取引を可能にし、プレイヤーの信頼を高めています。

未来への展望

オンラインカジノとオンラインギャンブルは、今後も技術の進歩とともに進化し続けるでしょう。人工知能(AI)の更なる統合、モバイル技術の発展、さらには新しいゲームの創造により、この分野は引き続き成長し、世界中のプレイヤーに新しい娯楽の形を提供し続けることでしょう。

この記事では、オンラインカジノとオンラインギャンブルの現状、安全性、技術の影響、そして将来の展望に焦点を当てています。この分野は、技術革新によって絶えず変化し続ける魅力的な領域です。

https://indiapharmacy.guru/# Online medicine home delivery indiapharmacy.guru

Абузоустойчивый сервер для работы с Хрумером, GSA и всевозможными скриптами!

Есть дополнительная системах скидок, читайте описание в разделе оплата

Высокоскоростной Интернет: До 1000 Мбит/с

Скорость Интернет-соединения – еще один ключевой фактор для успешной работы вашего проекта. Наши VPS/VDS серверы, поддерживающие Windows и Linux, обеспечивают доступ к интернету со скоростью до 1000 Мбит/с, гарантируя быструю загрузку веб-страниц и высокую производительность онлайн-приложений на обеих операционных системах.

Воспользуйтесь нашим предложением VPS/VDS серверов и обеспечьте стабильность и производительность вашего проекта. Посоветуйте VPS – ваш путь к успешному онлайн-присутствию!

escrow pharmacy canada [url=http://canadiandrugs.tech/#]pharmacies in canada that ship to the us[/url] best online canadian pharmacy canadiandrugs.tech

https://canadiandrugs.tech/# northwest canadian pharmacy canadiandrugs.tech

https://mexicanpharmacy.company/# mexican online pharmacies prescription drugs mexicanpharmacy.company

http://edpills.tech/# erectile dysfunction drugs edpills.tech

pharmacy canadian vipps canadian pharmacy – safe reliable canadian pharmacy canadiandrugs.tech

canadian online pharmacy northern pharmacy canada – canada pharmacy canadiandrugs.tech

https://canadiandrugs.tech/# canada cloud pharmacy canadiandrugs.tech

https://indiapharmacy.guru/# legitimate online pharmacies india indiapharmacy.guru

Абузоустойчивый сервер для работы с Хрумером, GSA и всевозможными скриптами!

Есть дополнительная системах скидок, читайте описание в разделе оплата

Виртуальные сервера (VPS/VDS) и Дедик Сервер: Оптимальное Решение для Вашего Проекта

В мире современных вычислений виртуальные сервера (VPS/VDS) и дедик сервера становятся ключевыми элементами успешного бизнеса и онлайн-проектов. Выбор оптимальной операционной системы и типа сервера являются решающими шагами в создании надежной и эффективной инфраструктуры. Наши VPS/VDS серверы Windows и Linux, доступные от 13 рублей, а также дедик серверы, предлагают целый ряд преимуществ, делая их неотъемлемыми инструментами для развития вашего проекта.

http://indiapharmacy.guru/# best online pharmacy india indiapharmacy.guru

canadian pharmacy no scripts [url=http://canadiandrugs.tech/#]legitimate canadian pharmacies[/url] canadian neighbor pharmacy canadiandrugs.tech

Как включить аппаратную виртуализацию

Абузоустойчивый серверов для Хрумера и GSA AMSTERDAM!!!

Оптимальная Настройка: Включение Аппаратной Виртуализации